Industry Statistics and Rankings

How does this industry perform in Russia compared to Europe?

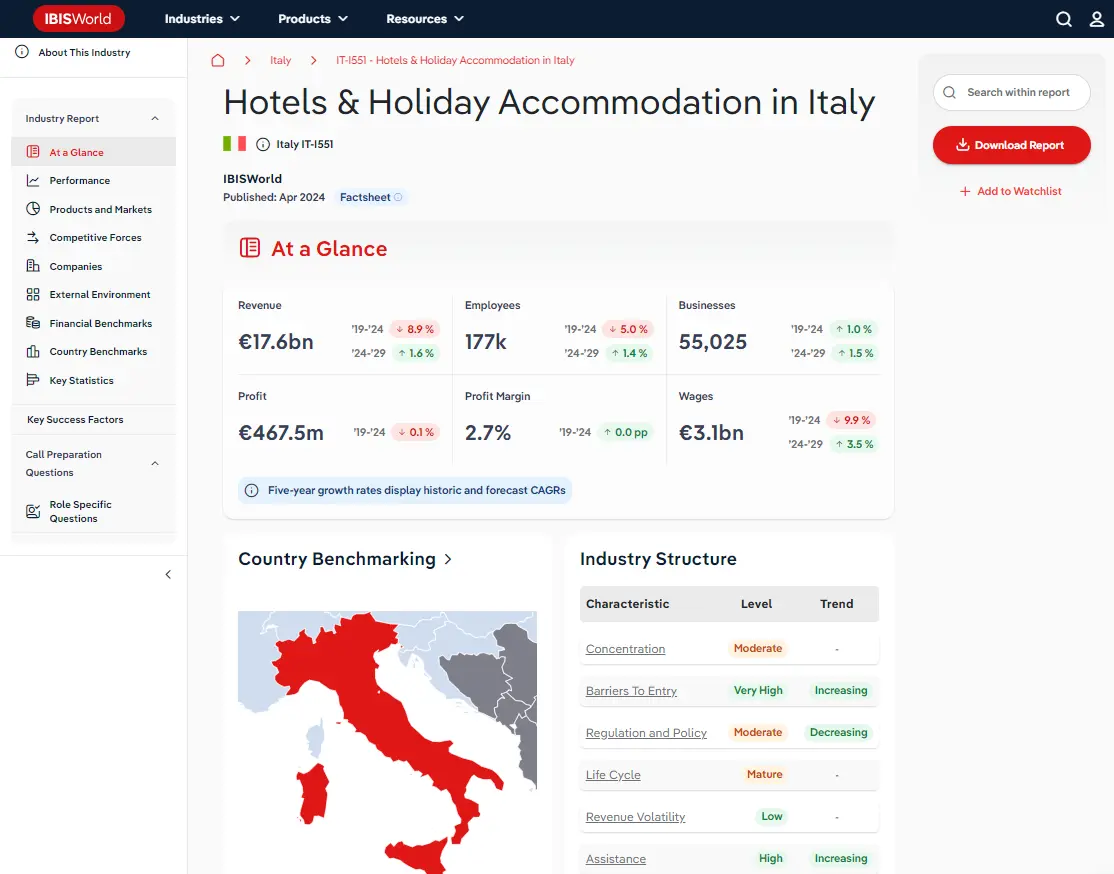

Country Benchmarking

Industry Data Russia

Ranking are out of 37 European countries for which IBISWorld provides country-level factsheets.

Revenue

#6 In EuropeBusiness

#5 In EuropeEmployees

#6 In EuropeWages

#13 In EuropeThe Engine & Turbine Manufacturing in Russia ranks 6 in Europe with regards to its 2025 revenue (€4.4bn). Revenue received by operators in Russia has been low in volatility over the past five-year period, with the average annual change in revenue (1.3 %) most comparable to...

Enterprises

Number of businesses in 2025

Revenue per Enterprise

Value (€ Million) in 2025

Top Questions Answered in this Report

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Engine & Turbine Manufacturing industry in Russia in 2025?

The market size of the Engine & Turbine Manufacturing industry in Russia is €4.4bn in 2025.

How many businesses are there in the Engine & Turbine Manufacturing industry in Russia in 2025?

There are 150 businesses in the Engine & Turbine Manufacturing industry in Russia, which has declined at a CAGR of 3.1 % between 2020 and 2025.

Has the Engine & Turbine Manufacturing industry in Russia grown or declined over the past 5 years?

The market size of the Engine & Turbine Manufacturing industry in Russia has been declining at a CAGR of 1.3 % between 2020 and 2025.

What is the forecast growth of the Engine & Turbine Manufacturing industry in Russia over the next 5 years?

Over the next five years, the Engine & Turbine Manufacturing industry in Russia is expected to grow.

What does the Engine & Turbine Manufacturing industry in Russia include?

Parts for engines with compression ignition and Turbines are part of the Engine & Turbine Manufacturing industry in Russia.

How competitive is the Engine & Turbine Manufacturing industry in Russia?

The level of competition is low and steady in the Engine & Turbine Manufacturing industry in Russia.

Related Industries

This industry is covered in 37 countries

Domestic industries

Competitors

Complementors

Table of Contents

About this industry

Industry definition

Companies in this industry manufacture internal combustion piston engines, including marine and railway engines and engine components. They also produce steam turbines and other vapour, hydraulic, wind and gas turbines, but not motor vehicles, aircraft engines or generator sets.

What's included in this industry?

Parts for engines with compression ignitionTurbinesParts for engines with spark ignitionEngines for water and rail vehicles and industrial enginesTurbine partsIndustry Code

2811 - Manufacture of engines and turbines, except aircraft, vehicle and cycle engines in Russia

Performance

Revenue Highlights

Trends

- Revenue

- 2025 Revenue Growth

- Revenue Volatility

Employment Highlights

Trends

- Employees

- Employees per Business

- Revenue per Employee

Business Highlights

Trends

- Businesses

- Employees per Business

- Revenue per Business

Current Performance

Charts

- Revenue in the Engine & Turbine Manufacturing Industry in Russia

- Employees in the Engine & Turbine Manufacturing Industry in Russia

- Business in the Engine & Turbine Manufacturing Industry in Russia

- Profit in the Engine & Turbine Manufacturing Industry in Russia

Current Performance

Analysis

How does this country's performance compare to Europe?

Life Cycle

Charts

- Industry Life Cycle Matrix

Products and Markets

Highlights

Trends

- Largest Market

- Product Innovation

International Trade

Heat maps

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

Competitive Forces

Highlights

Trends

- Concentration

- Competition

- Barriers to Entry

- Substitutes

- Buyer Power

- Supplier Power

ANALYSIS

What is the competitive landscape in Europe?

External Environment

Highlights

Trends

- Regulation & Policy

- Assistance

Key Takeaways

Manufacturers must abide by EU emission regulations. The Non-Road Mobile Machinery regulations (passed on 5 July 2016) necessitate that industrial engines emit significantly fewer nitrogen oxides and considerably reduce soot particle emissions.

External Drivers

Analysis

What demographic and macroeconomic factors impact the Engine & Turbine Manufacturing in Russia industry?

Financial Benchmarks

Highlights

Trends

- Profit Margin

- Average Wage

- Largest Cost

Key Takeaways

Manufacturers protect their profit by passing on rising costs. Steel prices are coming down, relieving pressure on profit as manufacturers up their prices. Many also entered into fixed-price supply contracts.

Cost Structure

Charts

- Share of Economy vs. Investment Matrix

-

Industry Cost Structure Benchmarks:

- Marketing

- Depreciation

- Profit

- Purchases

- Wages

- Rent

- Utilities

- Other

Analysis

What trends impact cost in the Engine & Turbine Manufacturing in Russia industry?

Key Ratios

Data tables

- IVA/Revenue (2015-2030)

- Imports/Demand (2015-2030)

- Exports/Revenue (2015-2030)

- Revenue per Employee (2015-2030)

- Wages/Revenue (2015-2030)

- Employees per Establishment (2015-2030)

- Average Wage (2015-2030)

Country Benchmarks

European Leaders & Laggards

Data Tables

Top and bottom five countries listed for each:

- Revenue Growth (2025)

- Business Growth (2025)

- Job Growth (2025)

European Country Performance

Data Tables

Rankings available for 37 countries. Statistics ranked include:

- IVA/Revenue (2025)

- Imports/Demand (2025)

- Exports/Revenue (2025)

- Revenue per Employee (2025)

- Wages/Revenue (2025)

- Employees per Establishment (2025)

- Average Wage (2025)

Structural Comparison

Data Tables

Trends in 37 countries benchmarked against trends in Europe

- Concentration

- Competition

- Barriers to Entry

- Buyer Power

- Supplier Power

- Volatility

- Capital Intensity

- Innovation

- Life Cycle

Key Statistics

Industry Data

Data Tables

Including values and annual change:

- Revenue (2015-2030)

- IVA (2015-2030)

- Establishments (2015-2030)

- Enterprises (2015-2030)

- Employment (2015-2030)

- Exports (2015-2030)

- Imports (2015-2030)

- Wages (2015-2030)

Methodology

Where does IBISWorld source its data?

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

France

France

Italy

Italy

Spain

Spain