Industry Statistics and Rankings

How does this industry perform in Ireland compared to Europe?

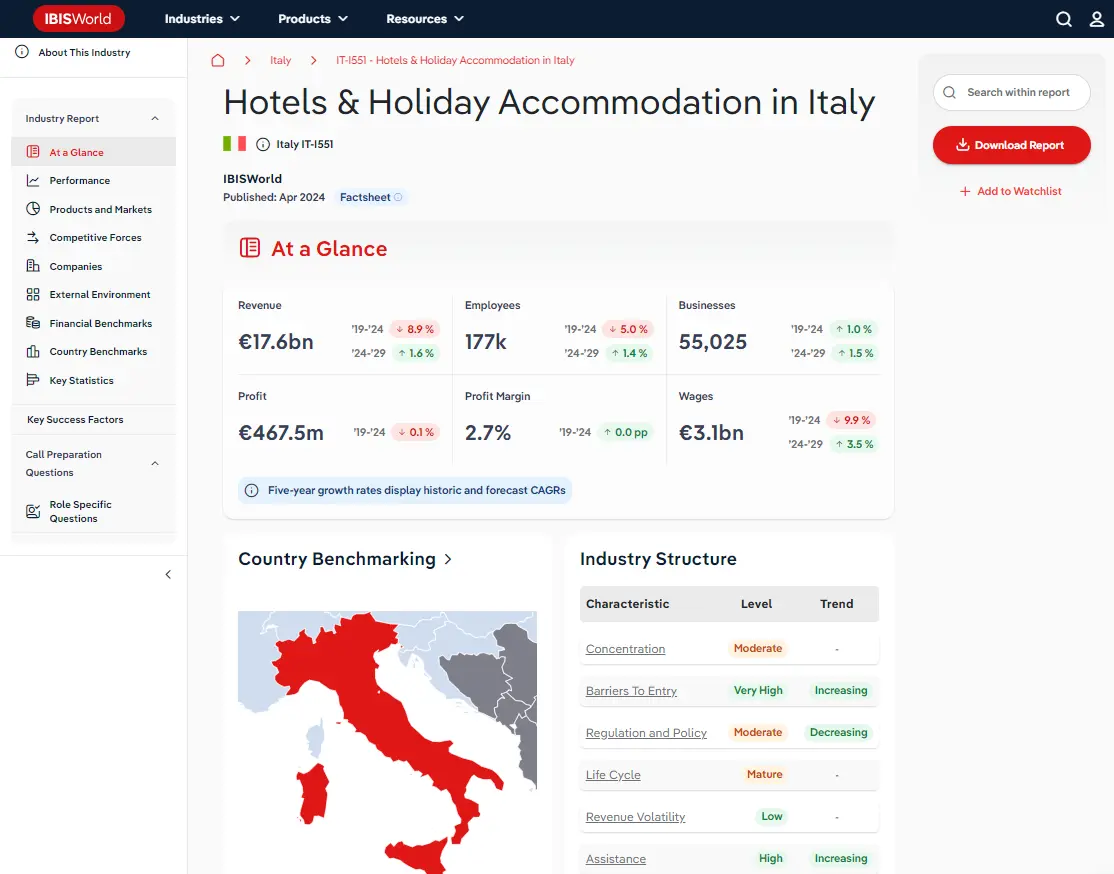

Country Benchmarking

Industry Data Ireland

Ranking are out of 37 European countries for which IBISWorld provides country-level factsheets.

Revenue

#13 In EuropeBusiness

#26 In EuropeEmployees

#13 In EuropeWages

#9 In EuropeThe Meat Processing and Preserving industry in Europe has faced several challenges over the past five years despite receiving government support. Over the five years through 2025, revenue is forecast to inch upwards at a compound annual rate of 1.1%. Europe’s meat sector faces mounting pressure from shifting demand, tighter supply, and rising costs. Health and sustainability concerns are eroding red meat consumption, while plant-based alternatives grew fivefold between 2011 and 2023. Southern markets such as Spain and Portugal remain culturally attached to meat, but Northern Europe is shifting faster towards alternatives. Affordability has become the decisive factor. With living costs high, consumers are trading down to pork and poultry, valued for versatility and relative affordability. Even wealthier households are cutting back, squeezing processor margins and weakening demand for premium cuts.Exports now provide a buffer. In Q1 2025, the EU shipped 1.12 million tonnes of pigmeat worth €3.14 billion (+3% volume, +2.7% value), with China and the UK as top buyers, Eurostat notes. But beef is retreating: output is forecast to fall 1.3% in 2025 while imports from Brazil and Argentina rise. Adding to pressures, processors face herd contraction, labour shortages, and high energy costs, pushing many to invest in automation, renewables, and value-added lines to protect profitability. In 2025, revenue is expected to dip 0.7% to €376.3 billion while profit is expected to reach 5.1% of revenue, a drop from 5.8% in 2020 thanks to cost pressures. Looking ahead, Europe’s meat processors face a challenging landscape. Over the five years through 2030, revenue is slated to grow at a compound annual rate of 3.3% to €442.3 billion, and profit is expected to reach 7.5% of revenue. The looming shadow of eco-consciousness will stifle meat demand, with the OECD projecting EU per-capita consumption will fall by 1.6 kg by 2035. Faced with swelling competition from alternative proteins, traditional meat processors will seek innovative strategies to retain market share. Still, meat's engrained cultural value in European societies will offer some relief. Traditional meals, culinary heritage involving meat and strong demand for locally-sourced produce will serve to protect meat processors’ sales over the coming years. Supply chains face added pressure from regulation. The EU Deforestation Regulation (EUDR), effective December 2025, will require geolocation tracking for all beef and leather holdings, with non-compliance risking fines of up to 4% of turnover. Meanwhile, the new EU packaging law adds costs, requiring recyclable formats and higher recycled content. Despite the subdued outlook, opportunities remain. The CAP 2025 reform shifts subsidies towards smallholders and young farmers while tightening import standards, creating cost risks for scale players but potentially strengthening rural networks.

Enterprises

Number of businesses in 2024

Biggest companies in the Meat Processing in Ireland

| Company | Market Share (%)

0 | Revenue (€short_0)

0 | Profit (€short_0)

0 | Profit Margin (%)

0 |

|---|

There are no companies that hold a large enough market share in the Meat Processing in Ireland industry for IBISWorld to include in this product.

Top Questions Answered in this Report

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Meat Processing industry in Ireland in 2025?

The market size of the Meat Processing industry in Ireland is €XX.Xbn in 2025.

How many businesses are there in the Meat Processing industry in Ireland in 2024?

There are €XX.Xbn businesses in the Meat Processing industry in Ireland, which has declined at a CAGR of XX.X% between 2019 and 2024.

Has the Meat Processing industry in Ireland grown or declined over the past 5 years?

The market size of the Meat Processing industry in Ireland has been stable at a CAGR of XX.X% between 2019 and 2024.

What does the Meat Processing industry in Ireland include?

Beef and Veal are part of the Meat Processing industry in Ireland.

How competitive is the Meat Processing industry in Ireland?

The level of competition is moderate and steady in the Meat Processing industry in Ireland.

Related Industries

This industry is covered in 37 countries

Domestic industries

Competitors

Complementors

Table of Contents

About this industry

Industry definition

Companies in this industry process livestock to produce red meat. They operate slaughterhouses, produce fresh, chilled or frozen meat as carcasses and cuts and produce by-products like rendered lard, tallow, offal and pulled wool. Industry participants also bone, preserve and pack meat.

Related Terms

CarcassDeboningCuringRedneringWhat's included in this industry?

BeefVealLambMuttonPorkPoultryRabbitCompanies

Industry Code

101 - Processing and preserving of meat in Ireland

View up to 0 companies with purchase. View purchase options.

Performance

Revenue Highlights

Trends

- Revenue

- 0 Revenue Growth

- Revenue Volatility

Employment Highlights

Trends

- Employees

- Employees per Business

- Revenue per Employee

Business Highlights

Trends

- Businesses

- Employees per Business

- Revenue per Business

Profit Highlights

Trends

- Total Profit

- Profit Margin

- Profit per Business

Current Performance

Charts

- Revenue

- Employees

- Business

- Profit

Analysis

What's driving current industry performance in the Meat Processing in Ireland industry?

Outlook

Analysis

What's driving the Meat Processing in Ireland industry outlook?

Volatility

Analysis

What influences volatility in the Meat Processing in Ireland industry?

Charts

- Industry Volatility vs. Revenue Growth Matrix

Life Cycle

Analysis

What determines the industry life cycle stage in the Meat Processing in Ireland industry?

Charts

- Industry Life Cycle Matrix

Products and Markets

Highlights

Trends

- Largest Market

- Product Innovation

Key Takeaways

Pork is the top revenue generator for meat processors in Europe. The variety of pork products on offer fuels strong demand for pork, while health concerns around beef limit it to second place.

Products and Services

Charts

- Products and Services Segmentation

Analysis

How are the Meat Processing in Ireland industry's products and services performing?

Analysis

What are innovations in the Meat Processing in Ireland industry's products and services?

Major Markets

Charts

- Major Market Segmentation

Analysis

What influences demand in the Meat Processing in Ireland industry?

International Trade

Highlights

- Total Imports into Ireland

- Total Exports into Ireland

Heat maps

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

Data Tables

Value and annual change (%) included

- Number of Imports and Exports by European Country (2024)

Competitive Forces

Highlights

Trends

- Concentration

- Competition

- Barriers to Entry

- Substitutes

- Buyer Power

- Supplier Power

Key Takeaways

Market share concentration varies by country. Germany, France and the UK are much more concentrated than other European nations, since a few major players dominate in these countries.

Supply Chain

Charts

Buyer and supply industries

Geographic Breakdown

Business Locations

Heat maps

- Share of Total Industry Establishments by Region (2024)

Data Tables

- Number of Establishments by Region (2024)

Charts

- Share of Establishments vs. Population of Each Region

Analysis

What regions are businesses in the Meat Processing in Ireland located?

Companies

Data Tables

Top 0 companies by market share:

- Market share (2024)

- Revenue (2024)

- Profit (2024)

- Profit margin (2024)

External Environment

Highlights

Trends

- Regulation & Policy

- Assistance

Key Takeaways

Meat processors are subject to stringent regulations. Legislation covers aspects like food safety, animal welfare and environmental standards. It aim to ensure high-quality products, ethical practices and environmental sustainability.

External Drivers

Analysis

What demographic and macroeconomic factors impact the Meat Processing in Ireland industry?

Financial Benchmarks

Highlights

Trends

- Profit Margin

- Average Wage

- Largest Cost

Key Takeaways

Sustainable practices drive profit growth. A growing interest in ethically sourced, environmentally friendly options encourages processors to conserve waste and energy and allows them to raise prices.

Cost Structure

Charts

- Share of Economy vs. Investment Matrix

-

Industry Cost Structure Benchmarks:

- Marketing

- Depreciation

- Profit

- Purchases

- Wages

- Rent

- Utilities

- Other

Analysis

What trends impact cost in the Meat Processing in Ireland industry?

Key Ratios

Data tables

- IVA/Revenue (2014-2029)

- Imports/Demand (2014-2029)

- Exports/Revenue (2014-2029)

- Revenue per Employee (2014-2029)

- Wages/Revenue (2014-2029)

- Employees per Establishment (2014-2029)

- Average Wage (2014-2029)

Country Benchmarks

European Leaders & Laggards

Data Tables

Top and bottom five countries listed for each:

- Revenue Growth (2024)

- Business Growth (2024)

- Job Growth (2024)

European Country Performance

Data Tables

Rankings available for 37 countries. Statistics ranked include:

- IVA/Revenue (2024)

- Imports/Demand (2024)

- Exports/Revenue (2024)

- Revenue per Employee (2024)

- Wages/Revenue (2024)

- Employees per Establishment (2024)

- Average Wage (2024)

Structural Comparison

Data Tables

Trends in 37 countries benchmarked against trends in Europe

- Concentration

- Competition

- Barriers to Entry

- Buyer Power

- Supplier Power

- Volatility

- Capital Intensity

- Innovation

- Life Cycle

Key Statistics

Industry Data

Data Tables

Including values and annual change:

- Revenue (2014-2029)

- IVA (2014-2029)

- Establishments (2014-2029)

- Enterprises (2014-2029)

- Employment (2014-2029)

- Exports (2014-2029)

- Imports (2014-2029)

- Wages (2014-2029)

Methodology

Where does IBISWorld source its data?

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

France

France

Italy

Italy

Spain

Spain