Industry Statistics and Rankings

How does this industry perform in Greece compared to Europe?

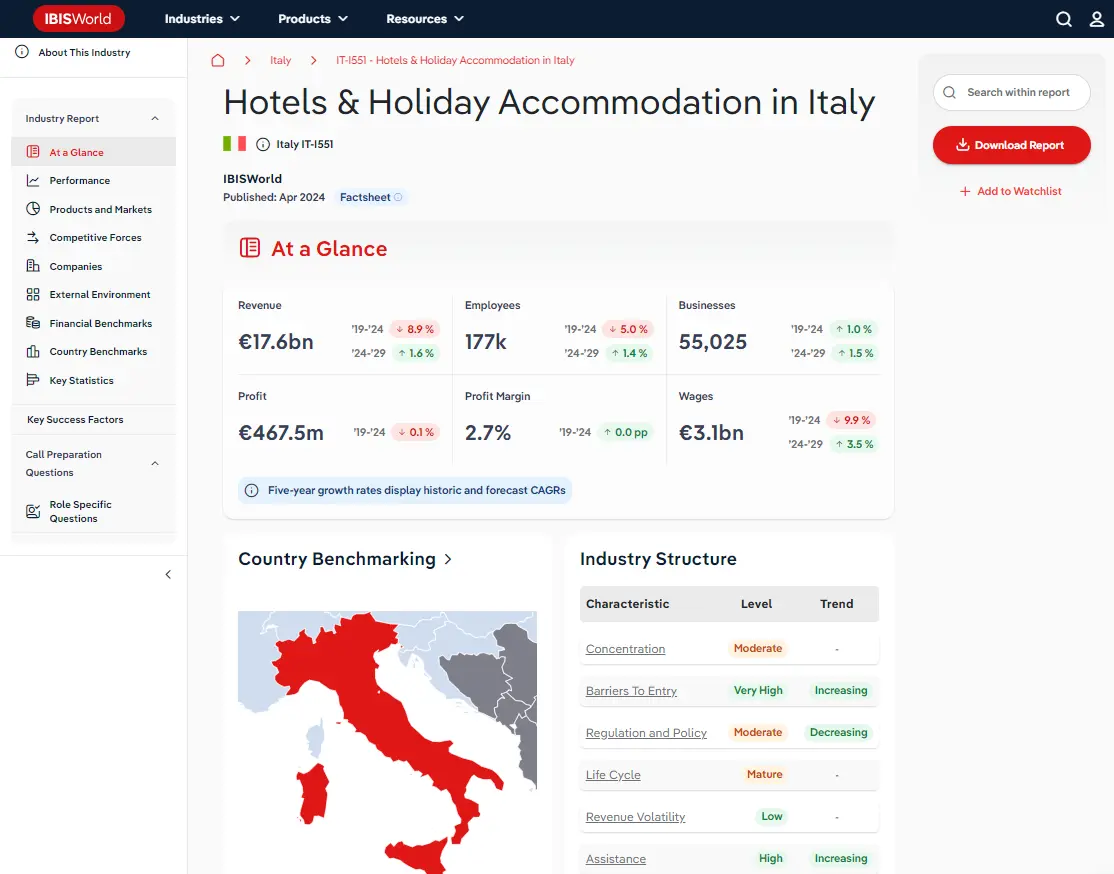

Country Benchmarking

Industry Data Greece

Ranking are out of 37 European countries for which IBISWorld provides country-level factsheets.

Revenue

#11 In EuropeBusiness

#11 In EuropeEmployees

#8 In EuropeWages

#12 In EuropeRevenue in the Travel Agencies industry is expected to grow at a compound annual rate of 12.3% over the five years through 2025 to €121.5 billion. The focus of the travel industry in the last five years has been recovering from the COVID-19 pandemic. Travel demand plunged during 2020 and 2021, when COVID-19 outbreak grounded flights and confined people to their homes. While domestic travel could continue in some countries, most travel agencies had no trips to sell. Since restrictions were lifted across Europe and globally (which happened at each country’s own pace), the travel sector has seen a resurgence in demand by trends characterised as revenge travel and responsible travel. People made up for lost time by taking more trips after COVID-19 restrictions had been lifted. In 2024 and 2025, consumers are still keen for trips but want value-for-money adventures instead as they’re cautious of their spending amid disposable income squeezes. International travel to Europe has also resurged, especially from the US, thanks to the more favourable dollar-to-Europe rate – a welcome trend for agencies. There’s concerns that President Trump’s administration and US tariffs could see a drop in US visitors, but in early 2025 numbers have been strong.

Enterprises

Number of businesses in 2025

Biggest companies in the Travel Agencies in Greece

| Company | Market Share (%)

2025 | Revenue (€m)

2025 | Profit (€m)

2025 | Profit Margin (%)

2025 |

|---|

There are no companies that hold a large enough market share in the Travel Agencies in Greece industry for IBISWorld to include in this product.

Top Questions Answered in this Report

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Travel Agencies industry in Greece in 2025?

The market size of the Travel Agencies industry in Greece is €2.3bn in 2025.

How many businesses are there in the Travel Agencies industry in Greece in 2025?

There are 2,306 businesses in the Travel Agencies industry in Greece, which has declined at a CAGR of 0.7 % between 2020 and 2025.

Has the Travel Agencies industry in Greece grown or declined over the past 5 years?

The market size of the Travel Agencies industry in Greece has been growing at a CAGR of 33.6 % between 2020 and 2025.

What is the forecast growth of the Travel Agencies industry in Greece over the next 5 years?

Over the next five years, the Travel Agencies industry in Greece is expected to grow.

What does the Travel Agencies industry in Greece include?

Online booking services and Travel agency services are part of the Travel Agencies industry in Greece.

How competitive is the Travel Agencies industry in Greece?

The level of competition is moderate and increasing in the Travel Agencies industry in Greece.

Related Industries

This industry is covered in 37 countries

Domestic industries

Competitors

- Land Transport Support Services in Greece

- Airport Operation in Greece

- Hotels & Holiday Accommodation in Greece

Complementors

Table of Contents

About this industry

Industry definition

This industry is composed of agencies that provide booking, reservation and information services to European residents travelling domestically and internationally and international visitors travelling in Europe. These agencies include those that are solely or partially online or shopfront businesses. Travel agencies generate their income from commissions.

Related Terms

BRICKS AND MORTARGLOBAL DISTRIBUTION SYSTEM ONLINE BOOKING SERVICESWhat's included in this industry?

Online booking servicesTravel agency servicesCompanies

Industry Code

7911 - Travel agency activities in Greece

View up to 0 companies with purchase. View purchase options.

Performance

Revenue Highlights

Trends

- Revenue

- 2025 Revenue Growth

- Revenue Volatility

Employment Highlights

Trends

- Employees

- Employees per Business

- Revenue per Employee

Business Highlights

Trends

- Businesses

- Employees per Business

- Revenue per Business

Profit Highlights

Trends

- Total Profit

- Profit Margin

- Profit per Business

Current Performance

Charts

- Revenue

- Employees

- Business

- Profit

Analysis

What's driving current industry performance in the Travel Agencies in Greece industry?

Outlook

Analysis

What's driving the Travel Agencies in Greece industry outlook?

Volatility

Analysis

What influences volatility in the Travel Agencies in Greece industry?

Charts

- Industry Volatility vs. Revenue Growth Matrix

Life Cycle

Analysis

What determines the industry life cycle stage in the Travel Agencies in Greece industry?

Charts

- Industry Life Cycle Matrix

Products and Markets

Highlights

Trends

- Largest Market

- Product Innovation

Key Takeaways

Europe remains the top holiday location for international arrivals. While Europeans travelling around Europe feel more confident booking travel plans independently, international tourists use agencies to hop around countries in Europe.

Products and Services

Charts

- Products and Services Segmentation

Analysis

How are the Travel Agencies in Greece industry's products and services performing?

Analysis

What are innovations in the Travel Agencies in Greece industry's products and services?

Major Markets

Charts

- Major Market Segmentation

Analysis

What influences demand in the Travel Agencies in Greece industry?

International Trade

Highlights

- Total Imports into Greece

- Total Exports into Greece

Heat maps

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

Data Tables

Value and annual change (%) included

- Number of Imports and Exports by European Country (2025)

Competitive Forces

Highlights

Trends

- Concentration

- Competition

- Barriers to Entry

- Substitutes

- Buyer Power

- Supplier Power

Key Takeaways

Larger agencies enhance their online presence. At the same time, a lot of bricks-and-mortar agencies have closed, helping OTAs agencies establish themselves. Fierce competition means the online market is rife with competitors.

Supply Chain

Charts

Buyer and supply industries

Geographic Breakdown

Business Locations

Heat maps

- Share of Total Industry Establishments by Region (2025)

Data Tables

- Number of Establishments by Region (2025)

Charts

- Share of Establishments vs. Population of Each Region

Analysis

What regions are businesses in the Travel Agencies in Greece located?

Companies

Data Tables

Top 0 companies by market share:

- Market share (2025)

- Revenue (2025)

- Profit (2025)

- Profit margin (2025)

External Environment

Highlights

Trends

- Regulation & Policy

- Assistance

Key Takeaways

Regulations give travellers protection. The European Package Travel Directive protects European travellers’ rights on package holidays and ensure customers are financially secure and safe.

External Drivers

Analysis

What demographic and macroeconomic factors impact the Travel Agencies in Greece industry?

Financial Benchmarks

Highlights

Trends

- Profit Margin

- Average Wage

- Largest Cost

Key Takeaways

The popularity of online travel agencies pushes up profit. Agencies with a greater online presence put less towards rent and wages than physical stores, meaning they see higher returns.

Cost Structure

Charts

- Share of Economy vs. Investment Matrix

-

Industry Cost Structure Benchmarks:

- Marketing

- Depreciation

- Profit

- Purchases

- Wages

- Rent

- Utilities

- Other

Analysis

What trends impact cost in the Travel Agencies in Greece industry?

Key Ratios

Data tables

- IVA/Revenue (2015-2030)

- Imports/Demand (2015-2030)

- Exports/Revenue (2015-2030)

- Revenue per Employee (2015-2030)

- Wages/Revenue (2015-2030)

- Employees per Establishment (2015-2030)

- Average Wage (2015-2030)

Country Benchmarks

European Leaders & Laggards

Data Tables

Top and bottom five countries listed for each:

- Revenue Growth (2025)

- Business Growth (2025)

- Job Growth (2025)

European Country Performance

Data Tables

Rankings available for 37 countries. Statistics ranked include:

- IVA/Revenue (2025)

- Imports/Demand (2025)

- Exports/Revenue (2025)

- Revenue per Employee (2025)

- Wages/Revenue (2025)

- Employees per Establishment (2025)

- Average Wage (2025)

Structural Comparison

Data Tables

Trends in 37 countries benchmarked against trends in Europe

- Concentration

- Competition

- Barriers to Entry

- Buyer Power

- Supplier Power

- Volatility

- Capital Intensity

- Innovation

- Life Cycle

Key Statistics

Industry Data

Data Tables

Including values and annual change:

- Revenue (2015-2030)

- IVA (2015-2030)

- Establishments (2015-2030)

- Enterprises (2015-2030)

- Employment (2015-2030)

- Exports (2015-2030)

- Imports (2015-2030)

- Wages (2015-2030)

Methodology

Where does IBISWorld source its data?

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

France

France

Italy

Italy

Spain

Spain