While inflationary pressures surfaced, the economy did too as real GDP rose 2.8% during Q3 2024. Increased consumer spending helped fuel downstream markets, boosting a significant part of the economy. There are positive movements in the labor market as higher job data for certain sectors like healthcare and financial services amid stronger downstream market activity with boosted spending on financial and health-related services helped this segment gain steam in the period. Construction experienced industry-wide turmoil during 2024, but certain segments like residential markets, remained stable during the period. However, there were still problems during the quarter. Inflation remained high and unemployment continued to be elevated, compared to 2023’s unemployment rates. These factors signal that more recovery is required before the economy rebounds.

Labor market

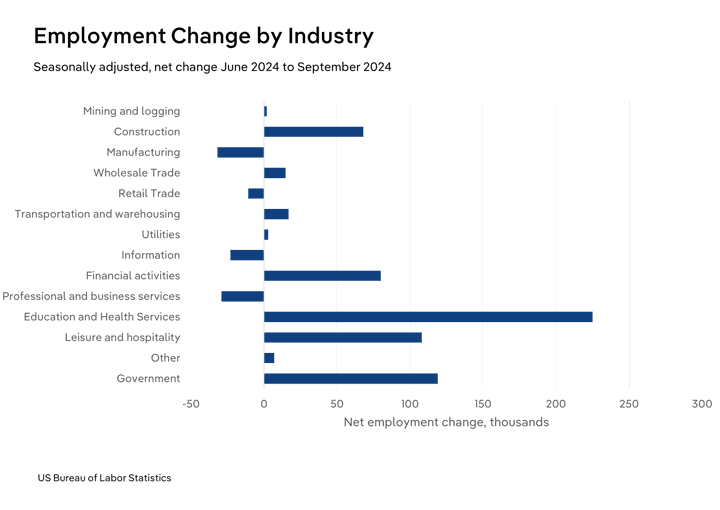

- Inflation has not stopped, but the labor market increased by 0.3% in Q3 2024. Sectors like financial services and educational and health services have been able to withstand inflation and interest rates as the market for these sectors remained essential. As interest rates started to scale down during the period, this helped more sectors preserve costs. This has led to a decent 477,000 boost in job growth in the quarter.

- Financial activities, education and health services led the way in terms of job growth, with each of these sectors going up by 0.9%, respectively. The recovering economy helped both industries as consumers spent and saved in the quarter, which fueled expansions for certain sectors. In conjunction with a recovering economy and more spending, the essential value of services like nursing, care facilities and healthcare sectors has kept up the need for workers to help care for those in need, including children and the elderly.

- Despite these positive gains in employment during the period, overall unemployment has still risen. As of September 2024, unemployment stood at 4.1%, a decent jump from last year's 3.9% but a slight drop from the start of the quarter's 4.3%. Since the labor market has expanded, this decrease hasn't been an indicator of a total market slowdown, but a reflection of a slowdown in specific markets like information and manufacturing, both of which lost jobs in the quarter.

- Average hourly earnings reached $35.46 in October 2024, a 4.0% bump from the previous October when it was $34.10. The value of labor remains upgoing as this has influenced more sectors to scale up their wages during this period to retain talent and attract newcomers. Labor unions have also influenced how much their members deserve to get paid, which helped such numbers.

Consumer spending:

- Spending increased in the third quarter of 2024, with quarterly growth up 1.2% from the previous quarter, while year-over-year spending was up by nearly 5.2%. As with past quarters, consumers have gravitated toward more services and goods that have value for them, such as health and housing, despite their higher costs, boosted this segment.

- Durable goods increased by 1.2% because of spending on furnishings, motor vehicles and parts. More individuals decided not to sell their homes and opted not to upgrade their vehicles, which boosted the need for equipment and parts to preserve their lifespans for extended periods. Such decisions kept spending for this segment up in the quarter.

- Non-durable goods have increased by 0.8% in the quarter as more consumers spend on items like other non-durable goods and food and beverages purchased for off-premises consumption. Goods like food and beverages remain essential despite higher prices, which has led to more spending on such items. The robust need for new prescription drugs this year has fueled more spending.

- Services rose by 1.4% in the quarter, with much higher spending on health care, financial services and insurance. More consumers need healthcare than ever despite their high costs, which boosted spending on these services. Insurance costs increased for certain sectors like healthcare and automobiles, which fueled more spending.

Inflation

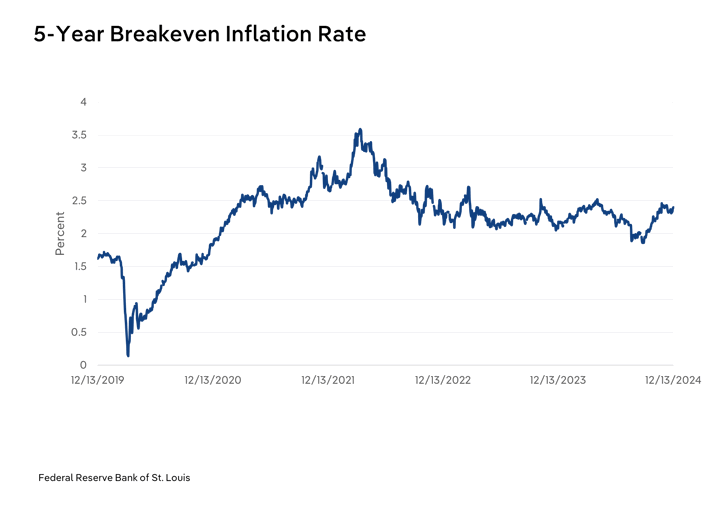

- Despite lower interest rates, inflation increased in the quarter, as the consumer price index rose by 0.5% from last quarter. Inflation remains above the Federal Reserve's preferred target rate of 2.0%, with the PCE price index going up 2.7% YOY in September 2024, as this suggests there is still progress to be made until the economy fully rebounds.

- The consumer price index scaled up in the period primarily due to increased prices for goods like eggs and higher admission prices for sporting events. Both led the way in terms of price boosts in the period as the price of eggs went up 22.0% while sporting events went up by 9.0%.

- However, prices have decreased for items like gasoline, which has slimmed 7.0% in the third quarter. Higher domestic energy production caused these categories to lose steam during this period. Such drops have kept the CPI slightly at ease in the period as it has grown less in the quarter than how much it has grown in the last quarter.

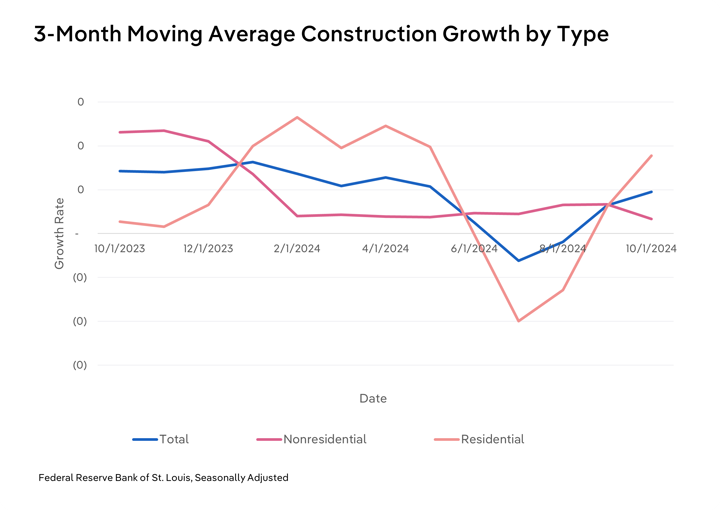

Residential construction

- For the third quarter of 2024, residential construction spending is up 0.3%, a sign that market activity has started to recover slightly. Interest rates go down and housing needs remain essential, this fueled certain market segments to go up in the period. The economic realities in how expensive these projects just are while if there is a strong enough demand for these projects prevented this market from fully rebounding.

- The Federal Reserve's decision to scale down interest rates has not led to a drop in mortgage rates, as 30-year fixed mortgage rates remain above 6.0% in the period. This is double the level rates were at five years ago.

- Low housing stock did not help abate high mortgage rates as construction activity has narrowed even more amid sharp drops in certain segments, like multi-family housing. At the same time, destructive hurricanes in the South have led to even more delays. In the period alone, total housing starts fell 4.4%, with multi-family units down nearly half of where they were last year.

- Amid these factors, the average sales price of sold houses reached $501,000 in the quarter. These prices reflect the low housing stock and elevated mortgage rates in the moment with it being above 6.0%. Existing home sales in September did reach nearly 4.0 million, but they also remained 0.5% lower than August. This slowed the need for more construction as homeowners stayed put and renters opted out of buying.

Nonresidential

- There has not been enough activity for the nonresidential construction sector to expand. Spending has been scaled down for these sectors by 0.1%, as the high expenses required for these projects keep various markets cautious about expanding until these market pressures subside.

- Not every sector is experiencing investing turmoil. Commercial and office real estate gained steam in the period as developers and investors figured out what to do with these projects, preventing the complete collapse of this industry.

- Positive trends in the public sector helped this industry out. It gained 1.0% in spending during the period, as pieces of legislation like the CHIPS Act and the Infrastructure and Jobs Act helped projects get the support they needed from the government.

Financial

- The economy kept a close eye on interest rates. The Federal Reserve cut in September as inflation began to pull back. This rate cut was an attempt to slow inflation.

- In response to economic developments, the stock market rallied in September. The NASDAQ reported a massive boom of 21.4% in value gain from last year, while the S&P 500 and the DJIA went up, too.

- Stock numbers fell early in the period, from July to August, following the Federal Reserve's decision to keep rates in place in response to less-than-stellar job data. This move increased volatility in the sector as the market waited for a better response.

Risk ratings

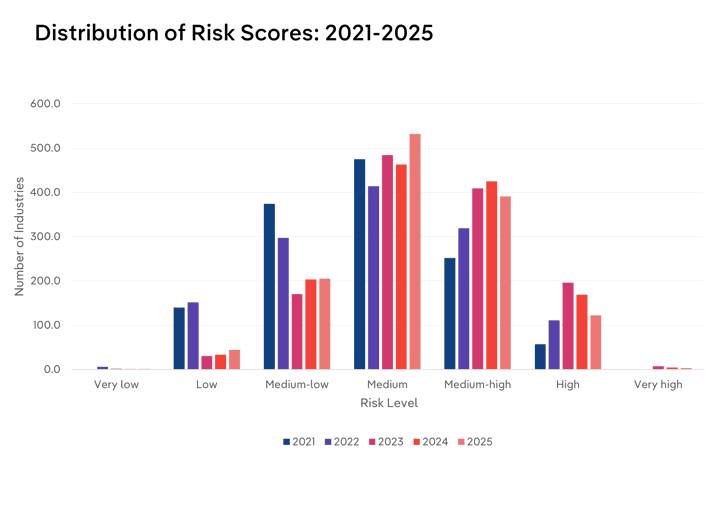

- Inflation and supply-chain issues continued to be a problem in 2022. As such, 33.1% of industries were rated as medium-high or under greater risk as the world began to respond to such pressures on the economy.

- As inflation remained an issue and interest rates worsened as they scaled up in 2024. This led to nearly 47.1% of industries being rated as medium-high or even higher during the year as markets struggled to respond to such factors.

- 2024 brought deceasing inflation and, beginning this quarter, lower interest rates. Such metrics remained high in the period, weighing on many businesses and consumers. This resulted in up to 46.1% of industries rated as medium-high or greater risk during the year.

- In 2025, interest rates are expected to start dropping. As such, these interest rates will be less of a volatile issue as the markets correct themselves, which would lead to 39.8% of industries being rated as medium-high or under greater risk.

Sector highlights:

- Mining: The market is moving away from coal, hurting this major industry. Various new regulations set by the EPA this year are alarming this industry. A new EPA rule in 2024 stipulates that anyone running a gas-powered coal plant should be capping any carbon emissions by nearly 90.0%. But a potential rollback of these regulations will help this sector out avoid such regulatory pressures from piling on in the future. Even then, the emergence of alternative energy sources like solar power has also been alarming for this sector because of its finite nature. As such, Coal Mining and Oil & Gas Field Services are set to be threatened by these factors.

- Healthcare and Social Assistance: The essential nature of medical-related services has fueled this sector during this period. Hiring has increased as the healthcare and social assistance market needs frontline workers who can care for more people per capita. There has been more spending for these sectors during the period as these services, despite their higher costs, helps them boost their revenue streams. Hospitals and Primary Care Doctors are helped by such trends.

- Construction: Spending has shifted elsewhere as elevated costs and high interest rates keep this sector from scaling up too much. More residential construction spending helps this sector gain lost ground in the period as the need for these buildings remains essential for homeowners. Downstream activity for the nonresidential field continues as formerly public buildings like malls and office spaces are converted into residential housing. Remodeling and Apartment & Condominium Construction have rebounded with these factors in the air.