Key Takeaways

- Deregulation will be a central focus of Trump’s second term, reshaping healthcare, energy, environment and finance policies.

- Tools like the Congressional Review Act and judicial review will empower the administration to swiftly dismantle Biden-era regulations.

- Industries such as fossil fuels, pharmaceuticals and financial services are poised to benefit, while others face potential challenges.

January 2025 marks the beginning of President Donald Trump’s second term in office, making him the only president besides Grover Cleveland to serve two non-consecutive terms. While President Trump is not known to be a predictable leader, his second term is expected to bring significant changes to US federal policy. The first Trump administration’s policies, along with promises made during the latest campaign cycle, provide some guide to the upcoming presidential agenda, who that agenda will impact and how the impacted parties should react.

Deregulation will be the watchword of the second Trump term, as it was during the first. Of particular focus for deregulation will be healthcare, energy, environmental and financial policy. Policies passed by the Biden administration under executive authority will be the least complicated to remove, and less integrated into daily American life. Those passed by acts of Congress will be tougher targets.

Nevertheless, widespread deregulatory efforts will necessarily result in winners and losers at the industry level. It is therefore crucial to examine the risks that exist within your business relationships today and weigh the impact of potential changes to industries interconnected to your own.

How will the Trump administration execute a deregulatory agenda?

The Biden administration will leave behind a substantial suite of executive orders that the incoming Trump administration will quickly be able to rescind and replace in the name of deregulation. These include orders promoting the fight against climate change, addressing immigration, restricting burgeoning AI technology and a rule modernizing regulatory review procedures.

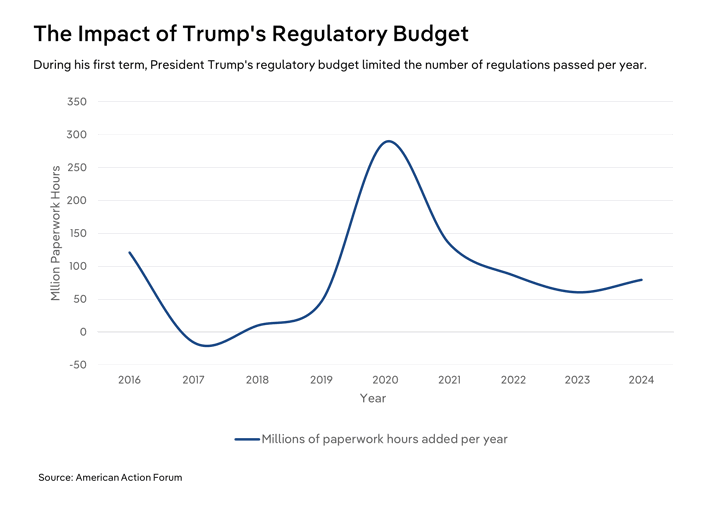

On day one, the incoming administration will likely put an immediate regulatory freeze on all rulemaking, which has become standard for new presidential administrations. Along with repealing Biden-era executive orders, the Trump administration will bring back some of its own, likely including reimplementing its “regulatory budget” framework, which limited the total cost of regulations passed by federal agencies and required agencies to eliminate two old regulations for each new regulation it passed.

For further deregulation early in the upcoming term, the Trump administration will turn to the Congressional Review Act (CRA), which allows Congress to repeal rules recently passed by federal agencies through a simple majority. This should allow President Trump, with his incoming narrow majorities in the House and Senate, to repeal some of the Biden administration’s final actions without worrying about a filibuster.

For example, on the environmental front, Trump will likely back out of the Paris Agreement (which outlines international decarbonization timelines) soon after taking office; he did so early in his first term, and then President Biden rejoined the agreement early in his term. On the other hand, President Trump will have a harder time rolling back provisions of the Inflation Reduction Act, even though he has rallied against the bill.

The Trump administration will have a few other tools in its deregulatory toolkit. One will be the new “Department of Government Efficiency” or “DOGE” set to be led by Elon Musk and Vivek Ramaswamy, which purports to have the mission of dismantling government bureaucracy, though its specific powers are not yet clear. The role of judicial review, another tool, will likely be more potent. The recent repeal of Chevron deference limits federal agencies’ rulemaking authority and could lead to more regulations being struck down via judicial review. Additionally, Trump may reimplement a policy to recategorize civil servants as “schedule F,” allowing for greater control over dismissing federal employees.

Key areas of deregulation

A handful of industries and issues are poised to be focus areas for deregulation in the coming years. One will be healthcare; the incoming Trump administration faces pressure to roll back the Biden administration’s policy, which allows Medicare to negotiate drug prices. Trump has previously supported other measures to lower prescription costs, but his plan is unclear. The incoming president may also make renewed attempts to overturn the Affordable Care Act, which he tried and failed to do multiple times during his first term.

Another area of focus will be energy and environmental policy. The Trump EPA will roll back regulations, including a rule that limits carbon emissions from power plants. The rule, finalized by the EPA in May 2024, was already set to be challenged in court. It is a successor to the Obama-era Clean Power Plan and the permissive Affordable Clean Energy Rule from the first Trump administration, which were both prevented from going into effect by litigation.

Beyond this rule, the EPA’s size and scope will be greatly diminished. The President-elect has indicated he would hamper ESG investing, revert policies promoting EV adoption, rescind remaining Inflation Reduction Act funding, pull out of the Paris Agreement and significantly increase fossil fuel production.

The financial sector will be a third area of focus for deregulation. The incoming administration seems likely to at least dramatically limit the scope of the Consumer Financial Protection Bureau. Still, administration advisors (including Elon Musk) have gone as far as proposing to eliminate the CFPB, the FDIC, and other financial regulatory agencies. On the other hand, the President-elect has mused about plans to cap credit card interest rates, a proposal that has been met with enthusiasm from Senator Bernie Sanders. If his first term is any guide, Trump’s financial regulation regime will be highly permissive, but the wholesale elimination regulatory agencies would clear a new bar of deregulation.

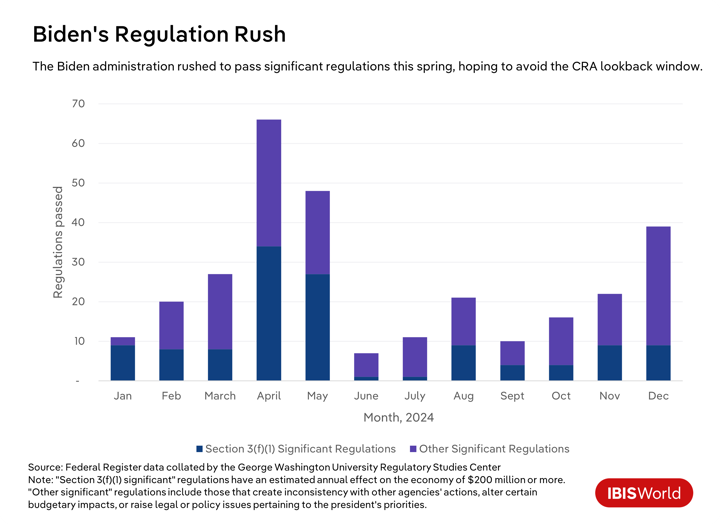

The Congressional Review Act (CRA) allows Congress to review and potentially overturn regulations finalized during a specific lookback period, which is determined based on when the new session of Congress begins. With the new session already underway, the lookback window is now fixed, and potential targets for CRA resolutions may include a limit on methane emissions, restrictions on lead and copper in drinking water, and consumer financial protections. To begin his first administration, President Trump signed an unprecedented number of CRA resolutions, so he will likely look to use the tool. However, anticipating this, the Biden administration rushed through a record number of regulations in April 2024, hoping to be outside the CRA lookback window. This could limit the CRA’s effectiveness to begin the new presidential term.

Winners and losers: Industries likely to benefit from deregulation

Pharmaceuticals and healthcare

A few industries will likely benefit from the second Trump administration’s deregulation efforts; pharmaceutical manufacturers and distributors hope to be among them. Leaders in the industry are pushing the incoming administration to revise or repeal the Medicare drug negotiation measures included in the Inflation Reduction Act while discussing the return of a failed policy from the first Trump term. The policy looks to peg Medicare drug prices to the prices paid by other developed nations, which are generally much lower than those paid in the US. The idea would be that this would force pharmaceutical companies to raise prices in those countries, thereby spreading costs more evenly across nations. However, the idea that these other nations will stand to pay higher prices for drugs is doubtful.

Energy

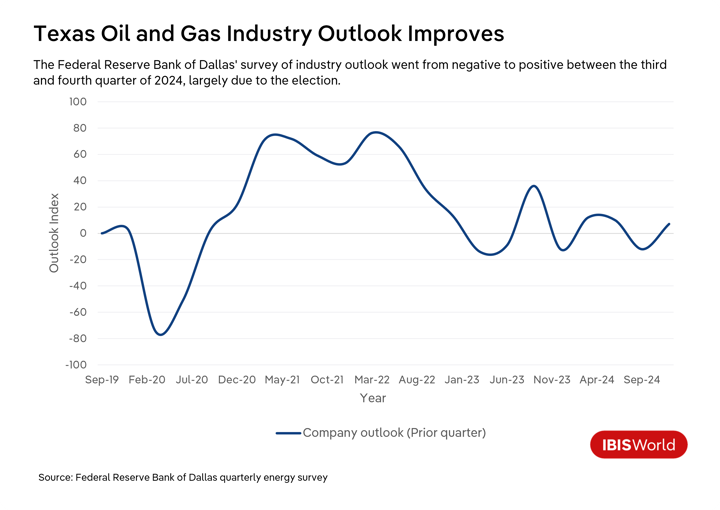

The energy sector is poised to see winners and losers resulting from the Trump administration’s policies. Players in the fossil fuel industry certainly have a positive outlook on the years to come, with the Trump team having clearly signaled support for increasing the US’ already record-high petroleum production. While industry operators have fears of low fossil-fuel prices, they anticipate that the Trump administration will lift the Biden administration’s ban on LNG exports, raising natural gas prices. On the other hand, players in renewable energy spaces are facing an incoming government that will provide much less support than the current administration and may even attempt to roll back some subsidies and support gained in recent years.

Financial services

Financial services providers are among the industries hoping to benefit from the deregulation efforts expected under the second Trump administration. A less restrictive regulatory environment, particularly with the anticipated weakening of the Consumer Financial Protection Bureau (CFPB), could offer banks and credit institutions opportunities to grow margins and adopt more flexible business models. With a reduced focus on consumer protection, financial institutions are eyeing the potential for more lucrative consumer products, especially in areas like fees, interest rates, and lending practices. The rollback of regulations that currently limit certain fee structures could lead to a more competitive landscape, particularly for large institutions looking to maximize profitability, with banks pushing for higher fees in areas such as overdraft protection, ATM usage and credit card interest rates. Additionally, reduced oversight on loan origination practices could allow lenders to explore more aggressive loan offerings in high-risk markets.

Navigating uncertainty: Key success factors for managing deregulation

Regulatory change impacts businesses differently depending on their relationship to the industry in question. Businesses operating within the industry that is being deregulated can benefit from opportunities for cost savings or strategy adjustments, while those adjacent to an industry may face downstream impacts that take longer to fully realize. Here are some key success factors that you can consider to help you assess industry risk and forecast future outcomes in a fluid policy environment.

1. Assess the impact of existing regulations on your business

- Review your compliance with key regulations impacting your industry. Take time to understand what parts of your business processes are implicated should certain regulations become undone.

- Identify your Tier 1 partners or suppliers and ensure that they are compliant with existing regulations. Consider adding a compliance questionnaire to your procurement process.

- Review contracts thoroughly to understand where you will or won’t be exposed to potential cost increases or service-level changes. Understand your responsibilities in case you are forced to terminate relationships.

2. Conduct or update your risk (or opportunity) assessments

- Quantify and document the financial and operational risks that seem most pressing to your organization.

- Determine the potential impacts of changing regulations on those risks and identify areas where the burden of risks may increase or decrease, depending on regulatory changes. Make sure to review state-level impacts of these changes.

- Evaluate your business and sales strategy by revisiting the analysis of potential expansion markets, and determine if deregulation could change the trajectory of expansion opportunities

3. Appoint a risk management specialist on your leadership team

- Ensure that there is organizational clarity on who is ultimately responsible for risk management and responding to regulatory changes.

- Implement a system for continuous tracking of executive orders, agency rulings, and judicial decisions ensures real-time awareness of ongoing policy changes.

4. Conduct scenario planning and revise risk mitigation strategies

- Create a dialogue among legal, finance, and operational teams to streamline the response to policy changes, fostering early detection of potential risks, balanced decision-making and driving a culture of transparency that keeps everyone alert to potential regulatory shocks.

- Revisit long-term forecasts to communicate with leadership in case of a sudden shift in the source or trajectory of business revenues.

- Start the process early for identifying new Tier 1 suppliers, so that you are more prepared to source key inputs from new vendors in case existing relationships need to be terminated.

5. Consider restructuring for more flexible resource allocation

- Use scenario planning models to build flexible teams that can be reassigned to new priorities if the regulatory landscape shifts suddenly.

- Evaluate substitutes for your key purchases and staffing requirements. Consider partnering with a consultancy to build up new or existing initiatives rapidly.

- Use cash reserves or open additional lines of credit to quickly invest in new streams of business growth.

The economic impact of deregulation

The macroeconomic impact of all this deregulation will be mixed. Sweeping deregulation can lead to cost savings for businesses by reducing compliance costs and boosting efficiency and innovation. It can drive economic growth by stimulating job creation and revenue growth, especially in energy, manufacturing, and finance. It can also increase investment by attracting investors and strengthening market confidence.

Conversely, deregulation comes with considerable economic risks, as these conditions increase financial instability and risk in the market. Deregulation was the primary driver of the 2008 global financial crisis. Fewer regulations will also raise the cost of environmental, social and other externalities. Regulations on fossil fuels, for example, look to shift the cost of burning those fuels onto those directly benefiting from petroleum. In general, deregulation increases economic disparities, benefiting large businesses and leaving smaller firms and consumers in the lurch.

Final Word

Trump’s agenda expands beyond deregulation, of course. He has made a range of promises on the campaign trail, including plans for mass deportations and blanket tariffs on imports, both of which will likely have a negative economic impact.

Deregulation, whether through executive order, the CRA, judicial review or other means, will, on its own, stimulate economic activity. Players in the pharmaceutical, energy and financial services are particularly hopeful they will see a windfall. Still, the future is uncertain and different industries will not fare equally, making industry research particularly useful in the coming months and years.