Key Takeaways

- Truckers’ responses to changing market conditions affect more than just their success. Missteps can cause companies in many industries to lose business, profit or both.

- The away-from-home trucking lifestyle and the older-than-average age of truck drivers have led to steady employee turnover that logistics companies are struggling to replace.

- Nearshoring, globalization, e-commerce and the beginning of interest rate cuts are bolstering freight volumes, but understaffing may limit trucking companies’ ability to fully meet their clients’ needs.

Trucks carry nearly three-quarters of all freight transported in the US, making businesses across the economy incredibly reliant on their dependable operations and successful navigation of logistical challenges. Truckers provide specialized services often absent in other transportation methods; for example, frozen food manufacturers rely heavily on refrigerated trucks to keep grocery stores and restaurants stocked with edible products.

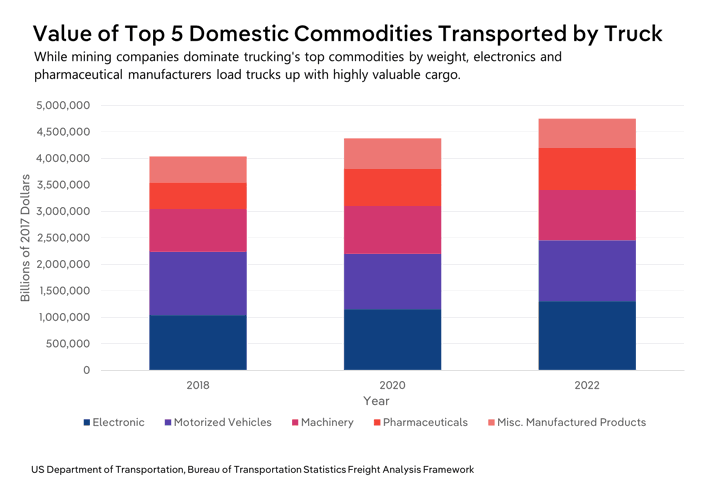

Truckers also ensure suppliers' least and most fragile products are promptly and safely delivered to other shipping method providers or directly to buyers. While some mining, agriculture and manufacturing companies can transport their inputs and outputs by rail or ship, the inherent infrastructure limits of trucking’s alternatives make trucks irreplaceable in the supply chain. Companies in a wide variety of industries must stay up to date on changing labor dynamics, regulations and innovations among truckers.

Trucking has profound ripple effects across the supply chain

Trucking companies are vital in helping many firms keep their buyers satisfied, and truckers with unreliable service quality hurt more than just their own reputation. Poor delivery times or damaged goods can push clients to do business with closer suppliers that are less exposed to on-the-road complications. For example, manufacturers or farming services contracted with struggling distributors may lose ground to competitors working with savvy trucking services that better retain drivers and operate at a higher capacity. Therefore, trucking companies must operate a cut above the rest when facing labor shortages, bottlenecks or full warehouses.

Companies in some key industries are especially reliant on truckers to provide reliable shipping. Pharmaceutical companies, farmers and food manufacturers can’t afford to lose significant inventory to trucks with faulty refrigeration systems. As many of these products are prone to spoilage if not promptly delivered, the impacts of understaffing and overcapacity are especially hard on suppliers. Competition or market dynamics force some of these companies to operate on razor-thin margins, so trucking companies that can’t manage high fuel or labor costs without significant price hikes can push their clients toward or into the red.

Truckers can also help suppliers improve their service quality and gain a competitive edge. Retailers and other buyers are increasingly prioritizing profit by taking a just-in-time approach for managing inventories to avoid overstocking, spoilage or accidental damage. Less-than-truckload (LTL) shipments have become more common than ever as manufacturers and wholesalers look to minimize delivery times and ensure clients have the supplies they need when they need them. According to US-based transportation company XPO Logistics’s annual SEC filings, shipments per day have gone up while weight per trip has gone down. Manufacturers that can afford LTL shipping’s higher price point can gain dominance in their markets by giving buyers greater flexibility over purchasing orders and delivery frequency.

Bottlenecks form as truckers tender their resignations

Manufacturing, mining and construction industries massively boosted their operations when pandemic-era lockdown orders were lifted, and pent-up demand was released. Trucking companies sought to rapidly adapt to the market’s new conditions but faced one major headwind: a labor shortage. Many carriers struggled to meet the flood of new freight orders as their workers left for careers in other industries. Warehouses and forwarding facilities inched toward maximum capacities as truckers struggled to deliver incoming products to retailers and end-users. Eventually, carriers passed much of their elevated operating costs onto suppliers and receivers, forcing them to raise prices themselves or face dampened profit.

Demographics play an integral role in the dynamic of truckers’ employee turnover. According to the latest US Census data, truck drivers are typically older than workers in other industries; truckers are 46 years old on average, compared to an average age of 40 across the US workforce. Other sources, including a survey from the Commercial Carrier Journal, place truckers’ average age near 60. Since older adults are more at risk of COVID-19’s threat to health, many truckers saw the pandemic as a good time to turn in their keys and exit the workforce. Also, the massive population of baby boomers in the trucking profession is steadily reaching retirement age, leaving trucking companies under immense pressure to bring on new workers to continue meeting their clients’ needs.

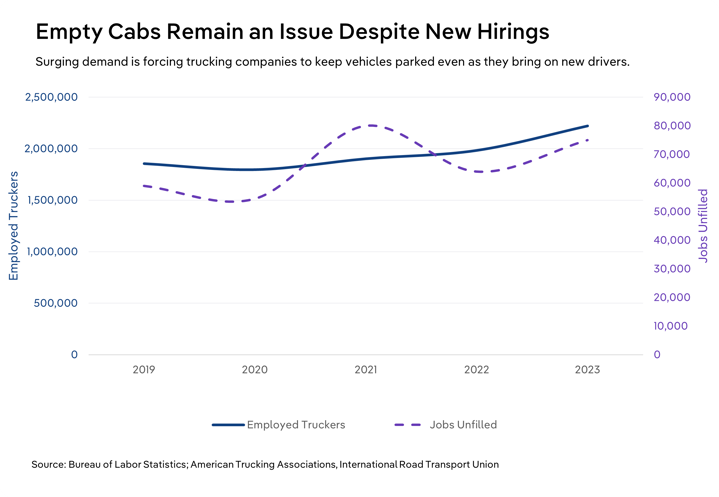

However, many potential hires aren’t enthusiastic about a career as a truck driver. While demand for truckers continues to expand, many don’t think the current pay justifies the job’s associated lifestyle. Capable workers are increasingly finding similar- or better-paying positions that don’t require them to sleep in their vehicles or spend multiple days away from home, concerns that are highest among careers in long-distance trucking. Without the ability to replace retiring drivers, trucking companies face workforce attrition that forces them to keep fully operational vehicles out of service. Trucking companies can respond by raising their salary offerings to better attract workers, but pressure from clients to keep rates steady is forcing many trucking services to absorb margin compression themselves.

The perceived drawbacks of the trucking lifestyle are at their peak in long-distance freight transportation. According to data from the Bureau of Labor Statistics (BLS), this smaller segment of the transportation sector is responsible for much of the trucking labor shortage. Its concentrated shortage appears to be directly tied to long-distance trucking companies’ sustained struggles to mitigate a high employee turnover rate. Their current drivers are increasingly moving to localized trucking jobs, while new commercial driver’s license (CDL) holders are increasingly choosing localized jobs as their entry point into the field.

Regulations make the labor shortage especially damaging for truckers and the businesses they serve. Hours-of-service (HOS) laws directly tie trucking companies’ labor force to how much freight they can move and how many clients they can satisfy. Limits to how much time drivers can spend behind the wheel without short or long breaks vary from nation to nation, with China, Brazil, Mexico and countries in the European Union (EU) limiting drive times to eight or nine hours, while the US and Canada allow drivers to remain on the road for up to 11 and 12 hours, respectively. HOS laws are enforced to varying degrees worldwide, but countries like Canada, Brazil and Australia have recently tightened their regulations by mandating that truckers report compliance through automated electronic logging devices.

The market’s current trends are making it especially hard for logistics companies to handle the labor shortage. The explosion of e-commerce has pushed demand for fast and reliable shipping through the roof, with growth in e-commerce sales outpacing general consumer spending 9.0% since 2019. Since truckers deliver online-purchased products directly to consumers, retailers must cut down delivery times to attract consumers. Competition with massive retailers like Amazon, which have efficient in-house trucking operations, continues to make speedy transportation especially important. However, LTL transportation is essential for providing fast and reliable shipping. LTL-shipped products need to be loaded and unloaded at more points in the supply chain, making their delivery incredibly labor-intensive and exposed to bottlenecks at forwarding facilities.

How can companies sidestep the truck driver labor shortage’s ripple effects?

- To navigate the truck driver labor shortage, companies can partner with larger suppliers. These suppliers typically hold bulk transportation contracts, giving them priority with trucking companies and access to better-managed logistics solutions.

- Larger suppliers also have the leverage to negotiate lower transportation costs. By securing contracts with trucking companies that pay drivers better, they can minimize the financial strain caused by labor shortages.

- Businesses can also work with transportation services that use subcontractors. Trucking companies with owner-operators can quickly adjust their operations, offering greater flexibility in times of labor shortages.

Truckers are chugging toward automation and a new level of efficiency

Present and future advancements in autonomous trucking are pushing toward revolutionized supply chains. Fully autonomous vehicles promise to cut labor costs, hasten delivery times and elevate logistical efficiency. The development of autonomous trucks is steadily moving forward, but the navigation of intricate urban roadways remains a pain point for manufacturers. Companies like Waymo, Aurora, Embark and Nuro have found some success with autonomous trucking in last-mile delivery and on simpler-to-navigate freeways and test tracks. These tests are currently unprofitable but gain significant attention from investors. Despite their potential benefits, a lack of a regulatory framework and emphatic pushback from unions make it difficult for trucking companies to fully integrate the technology.

Truckers continue to struggle with labor intensity as automated solutions face several hurdles, but other recent innovations have offered some relief. Technologies like real-time tracking and platooning, which connects trucks in a convoy, have begun to improve fuel efficiency, cut labor costs, reduce emissions and promote road safety. The integration of AI and predictive analytics is also helping trucking companies dodge some complications by identifying potential on-the-road issues and providing alternative routes, enhancing efficiency, supporting reliability and mitigating risk factors.

The move toward sustainable trucking will impose significant variations in pricing policies

Tightening Environmental Protection Agency (EPA) guidelines and trade association-prodded green initiatives are pushing trucking companies to invest in new, lower-emission vehicles. Beginning in 2027, all heavy-duty trucks must report far lower nitrogen oxide, greenhouse gases and particulate matter emissions than previously allowed. Making their fleets more sustainable costs logistics companies significant capital, though truckers typically pass these expenses onto clients. Trucking and oil extraction organizations have recently sued the EPA, calling the new regulations unrealistic and overreaching.

Truckers have a few options when pursuing lower emissions. Biodiesel holds the position as the most common solution at the moment, but it’s not without its setbacks. While new federal tax incentives help drop the cost of converting truckers’ fleets, biodiesel prices can spike when droughts slash corn or soybean production. Electric trucks also present a renewable solution, but batteries’ additional weight limits how much each truck can carry. A lackluster recharging infrastructure also limits truckers’ options, a challenge mirrored in hydrogen- and compressed natural gas (CNG)-fueled trucks. High production costs also make hydrogen more expensive than diesel, and many truckers are concerned that CNG trucks are less viable in the long run.

What are the implications of trucking companies’ innovations on upstream and downstream industries?

- While currently unprofitable, autonomous trucking may allow larger logistics companies to dominate. Dropping labor expenditures will enable trucking services to undercut non-automated truckers’ prices. Both shippers, such as vegetable farmers or processed meat manufacturers, and receivers, like dairy wholesalers or camera stores, may need to rely more on one carrier to save on transportation costs.

- Sustainable solutions require additional investment from trucking companies, a cost they typically try to recoup through heightened rates. Clients like coal miners and carpenters likely face steeper transportation costs.

- Upstream suppliers like pharmaceutical or electronics manufacturers may need to pay greater transportation costs as renewable fuel and recharging infrastructure in nearshored manufacturing locales significantly lag domestic development.

Trucking companies are adapting to changing global manufacturing trends

Logistics services’ top clients, especially manufacturers, are increasingly turning to nearshoring as a path to efficient operations while lowering their exposure to supply chain disruptions. For instance, many manufacturers in the US are moving their production facilities from countries with cheap labor in Southeast Asia to areas in Mexico. While sourcing material inputs in Mexico-based manufacturing facilities can be more costly than in overseas locales, their proximity to US markets makes the tradeoff worthwhile to many companies. Key benefits include shorter transportation times, reduced tariffs through the United States-Mexico-Canada Agreement and lower inventory carrying costs. Nearshoring is also ramping up across the Atlantic as European manufacturers shift their focus to countries like Poland, Hungary and the Czech Republic. Faster shipping and more responsive production cycles allow electronics, clothing, household products and other manufacturers to offer better service to buyers in increasingly competitive industries.

Nearshoring’s growing popularity pushes multinational carriers to adapt by expanding their reach and capabilities in sought-after locales. XPO Logistics, the industry leader in the US’s local and LTL shipping industries, launched its new XPO Mexico+ initiative in July of this year. XPO Mexico+ expands the number of the company’s border-crossing points to seven and broadens its postal code reach to 99.0%, indicating XPO’s ability to provide a new level of access to growing markets in the US’s southern neighbor. Investing in new depots and fleets in popular nearshoring destinations is becoming more important as truckers seek to follow the producers of over 40.0% of their freight. As manufacturing and transportation operations stretch across national borders, investing in telematics and prioritizing smooth communication between shippers and carriers will be paramount to success and efficiency.

How can logistics consultants help clients navigate nearshoring?

- Professionals can help clients identify potential suppliers in nearby countries, evaluating their capabilities, reliability and compliance with domestic quality standards.

- Logistics experts can help manufacturers assess potential congestion points in their new distribution channels.

- Logistics professionals can use their telematics and machine learning tools to streamline operations and find optimal routes or operating locations.

Interest rate cuts and trade dynamics will further boost trucking

The US Federal Reserve instituted its first post-pandemic interest rate cut in September 2024, dropping rates by a steeper-than-expected 0.5%. Further north, the Bank of Canada instituted three rate cuts since June. Some question how much these cuts actually support a new wave of investment activity, but additional rate cuts through 2025 are set to bring larger support for freight transportation in North America. Renewed confidence in the US and Canadian economies will help foster greater construction, mining and manufacturing activity, translating to greater demand for truck drivers.

Mounting globalization will also bolster the need for streamlined trucking operations. While nearshoring will remain a prominent trend, the growing interconnectedness of nations will support international trade. Truckers play a key role in moving goods between ports, rail stations and forwarding centers, making heightened international trade a boon for carriers and logistics professionals. Still, global conflicts and changes to tariff policies can rapidly disrupt trade dynamics, as seen most recently in the Russia-Ukraine war.

Final Word

Whether it’s a large corporation or a mom-and-pop shop, the trucking industry directly affects many businesses’ bottom lines. Labor shortages, regulatory constraints and technological advancements are reshaping how goods pass through the supply chain. Trucking is set to become more expensive as logistics services invest in sustainable models and struggle with sustained barriers to retaining drivers. Companies across their nation’s economy may need to adapt by consolidating or changing suppliers.

Autonomous trucks may revolutionize trucks’ presence on freeways around the world, but persisting barriers will keep labor at the center of long-distance and local trucking. Globalization and interest rate cuts are set to bolster demand for trucks, exacerbating labor-related capacity issues and raising transportation costs for shippers and receivers. Supply chain managers must proactively engage with developments in logistics to navigate the complexities ahead. As supply chains evolve, staying informed and aware of what goods carriers can most effectively transport will be central to success for businesses in many industries.