Key Takeaways

- Partnerships built on instinct, not data, often lead to financial losses and strategic misalignment.

- Choosing the right industry first ensures partnerships thrive in sustainable, high-growth markets.

- A booming industry doesn’t guarantee a strong partner—benchmark financials to avoid hidden risks.

- Ongoing industry tracking keeps partnerships resilient as market conditions evolve.

Strategic partnerships can open doors to new markets, create revenue opportunities and strengthen competitive positioning. But not all partnerships lead to success. The wrong collaboration can result in financial losses, reputational damage and operational setbacks.

Business leaders face increasing pressure to make informed partnership decisions, especially in industries where market conditions shift quickly. Relying on instinct or past successes isn’t enough – partnerships need to be backed by solid data.

With over a decade of experience managing large enterprise accounts across market research, financial services and retail, I’ve seen how industry intelligence supports smarter decisions. IBISWorld equips businesses with the data needed to select the right industries, vet potential partners and anticipate risks—so every collaboration supports long-term success.

Here’s how we help decision-makers build stronger, data-backed partnerships.

How can you find industries with long-term growth potential?

Industry selection isn’t just an operational decision – it’s a defining factor in whether partnerships thrive or fail. Choosing the wrong industry can leave businesses trapped in shrinking revenue pools, while strategic moves into sustainable sectors create long-term competitive advantages.

Yet many executives or decision-makers still make reactive decisions about industry selection, relying on past performance, competitor actions or market hype. These approaches often lead to misalignment and missed opportunities.

- Internal sales data may show strong past performance, but it doesn’t account for emerging risks like new regulations or market shifts.

- Following competitors might seem like a safe bet, but by the time an industry is crowded, opportunities have already narrowed.

- Jumping on media hype can be dangerous – fast-growing sectors may dominate the headlines, but growth fueled by speculation rarely lasts.

Those who rely on these reactive approaches often find themselves investing in industries too late – or worse, committing to partnerships in sectors that are already in decline.

The shift to proactive industry selection

Instead of looking in the rearview mirror, corporate leaders need to focus on where industries are heading. Yet, only 22% of firms produce forecasts within 5% of actual results, while most companies face an average forecasting error of 13%. These inaccuracies can significantly impact business performance and decision-making, making reliable forecasting tools essential for staying ahead. IBISWorld’s forecasting tools help decision-makers identify industries with real, sustainable growth potential before the competition catches on.

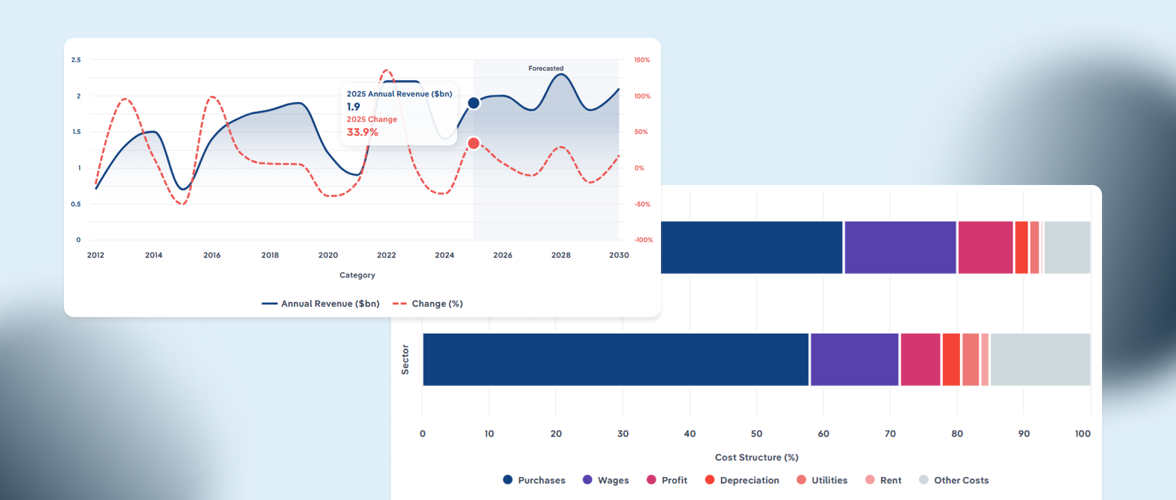

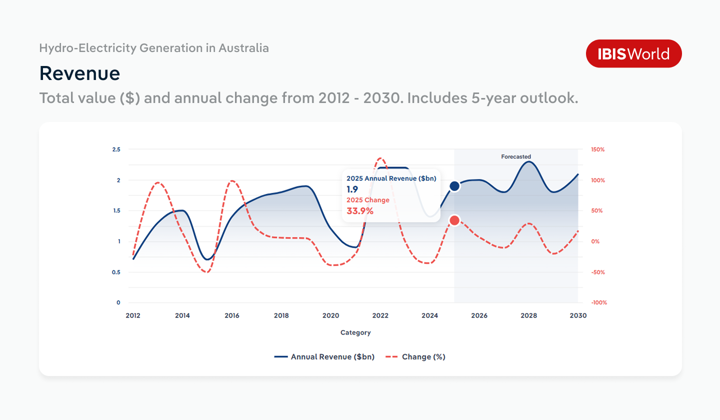

Industry Growth Forecasts provide clear, at-a-glance insights on five-year revenue projections, macroeconomic trends and industry-specific demand drivers. Instead of sifting through dense reports, you can quickly pinpoint industries positioned for longevity and focus on the most strategic opportunities.

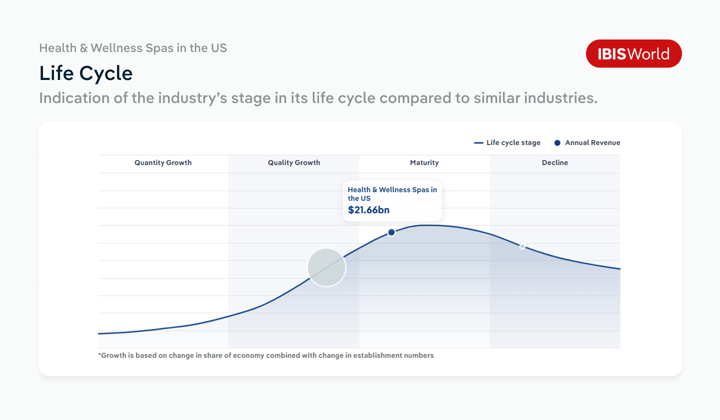

Industry Lifecycle analysis presents a clear, visual breakdown of where an industry stands today – whether it’s an expansion phase with untapped potential, a mature phase requiring a different approach, or a declining phase where risks outweigh rewards. With intuitive charts, decision-makers can quickly compare industry trajectories and make faster, more confident decisions without getting lost in unnecessary complexity.

Why the right industry selection defines partnership success

The most successful businesses first choose the right industries. By aligning partnerships with industries positioned for long-term success, they can:

- Drive sustainable profitability: Industries with proven long-term demand create more stable, higher-value opportunities.

- Reduce risk exposure: Avoiding industries under regulatory pressure or economic strain minimizes financial and operational risk.

- Build an early-mover advantage: Decision-makers who identify industry shifts early build relationships before the market becomes saturated.

Strategic leaders anticipate where value is emerging and act ahead of the curve. With IBISWorld’s forecasting and lifecycle tools, they gain the clarity needed to align partnerships with industries that offer lasting competitive advantages.

Industry selection lays the groundwork for success, but long-term growth depends on choosing the right partners within those industries.

Evaluate partners with data, not just gut instinct

Choosing the right industry is only a fraction of the equation – choosing the right partners within that industry is the next step.

Even in high-growth, expansion phase industries, not every company is equipped to sustain profitability and growth. Some firms thrive because of strong financial and operational fundamentals, while others are simply riding a temporary market boom. Without clear benchmarking, it’s impossible to separate high-value partnerships from high-risk investments.

Many leaders assume that if an industry is thriving, every company within it must be a strong potential partner. But growth alone doesn’t guarantee financial resilience. Some businesses experience rapid expansion but operate with unstable financials, low profit margins or high external risks.

Without a structured, data-backed approach, decision-makers risk investing in partners that appear strong on the surface but lack the financial or strategic foundation to go the distance. It’s no wonder that up to 50% of business partnerships fail.

A decision-makers near miss – and what they learned

I recently worked with a senior executive at a health investment firm who was evaluating a partnership with a rising pharmaceutical manufacturer. The company had gained attention for its innovative drug pipeline and fast-growing operations, stepping in as global pharmaceutical firms exited local manufacturing.

The executive was confident in the opportunity – on the surface, the company was expanding quickly and securing major contracts. But before finalizing the deal, they wanted to validate their instincts with industry-wide benchmarking and risk analysis.

What IBISWorld’s data revealed:

- Market fragmentation: The company was part of a wave of small-scale pharmaceutical manufacturers, the majority of which earned less than $2 million annually. While growth was strong, competition was intensifying, and margins were shrinking.

- Financial stability concerns: Despite revenue growth, the company’s profit margins were below industry benchmarks, putting long-term sustainability in question.

- Regulatory pressures: Pricing controls under the Pharmaceutical Benefits Scheme (PBS) were limiting manufacturers’ ability to set prices, tightening revenue streams across the sector. Compliance costs were also rising, adding pressure on pharmaceutical firms to maintain profitability.

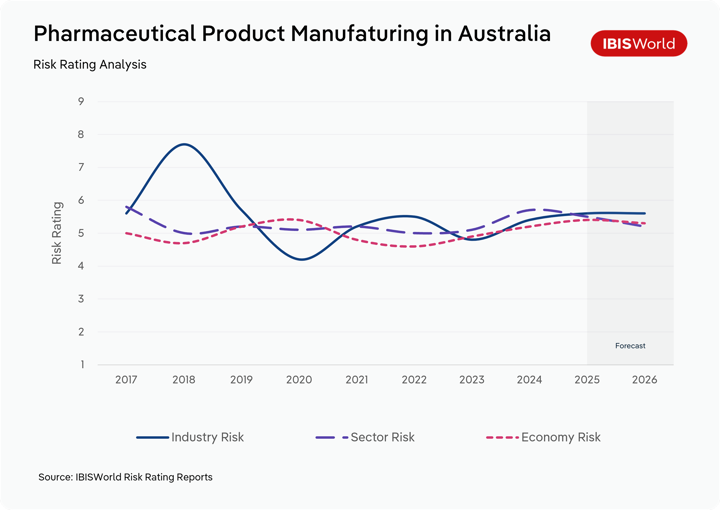

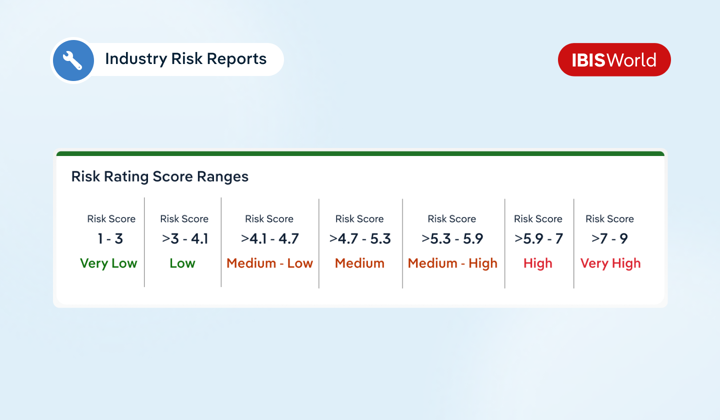

- Medium-high industry risk rating: The pharmaceutical industry carried high structural risk, with intense competition and pricing pressures squeezing profitability. Medium-high sensitivity risk meant that PBS pricing structures and federal funding decisions were influencing revenue stability.

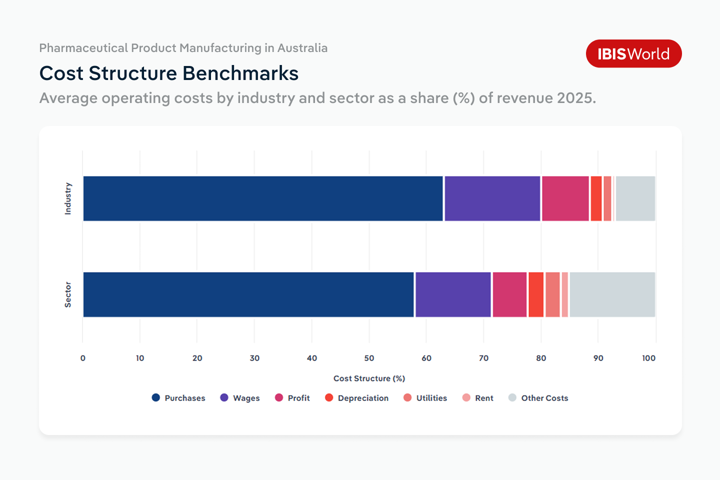

- Cost pressures in the industry: Benchmarking confirmed that procurement costs were high across the industry, largely due to Australia’s reliance on imported active pharmaceutical ingredients and recent supply chain disruptions. Purchases accounted for 63% of industry revenue, limiting profitability for many manufacturers.

The risk

The decision-maker realized that without this data, they would have been relying on surface-level indicators, potentially forming a partnership with a company lacking the financial stability or strategic foundation to succeed. The company’s momentum looked strong, but the underlying financials and industry risks suggested a high-risk, low-margin operation.

The decision

Instead of proceeding, they used IBISWorld’s benchmarking and risk rating tools to identify a more financially stable partner—one with diversified revenue sources, better cost efficiency and stronger long-term viability.

Key takeaway

Industry growth doesn’t guarantee a strong partnership. Businesses need a structured, data-driven approach to separate sustainable businesses from high-risk ventures. With IBISWorld’s risk ratings and benchmarking dashboards, decision-makers can move beyond gut instinct and make informed, strategic choices.

How IBISWorld helps assess partner viability

Making partnership decisions shouldn’t rely on guesswork or be a time-consuming process of gathering scattered financial reports and market research. Executives need a fast, structured way to assess partner viability with confidence.

We provide benchmarking dashboards, financial comparisons and industry risk assessments in an intuitive, at-a-glance format, helping businesses quickly evaluate financial health, competitive positioning and external risks.

With these tools, decision-makers can:

- Quickly compare financial stability against industry norms: Instead of evaluating a company in isolation, executives can instantly see how its profit margins, cash flow and debt levels compare to competitors.

- Spot early warning signs before they become liabilities: Risk ratings highlight companies in industries facing regulatory scrutiny or emerging risks, allowing decision-makers to pivot before challenges escalate.

- Determine if growth is sustainable or short-term: Industry benchmarking provides a fast-read on whether a company’s success aligns with long-term industry and sector performance or is simply a result of short-term trends.

- Reduce decision-making complexity: Side-by-side financial comparisons and risk ratings eliminate the need for time-consuming analysis, making it easier to filter out unstable partnerships early and focus on long-term potential.

By integrating this level of fast, structured analysis, businesses can ensure that partnerships align not only with immediate strategic goals but also with long-term market positioning—without getting bogged down in unnecessary complexity.

Stay ahead of industry risks that could derail partnerships

A strong partnership today doesn’t guarantee success tomorrow. Shifting regulations, economic volatility and competitive pressures can turn even the most promising collaborations into liabilities. Without ongoing industry tracking, businesses risk being locked into partnerships that no longer align with their strategy.

Why long-term partnerships require continuous insight

Many executives assess risk only at the start of a partnership, assuming that a strong initial fit guarantees lasting success. But as market conditions evolve, so do the risks and opportunities associated with a partnership.

Some partners may struggle to keep pace with cost pressures, regulatory changes or industry-wide challenges that weren’t apparent at the outset. If executives rely only on initial due diligence, they risk missing emerging threats that could erode the partnership’s value.

For instance, General Motors’ partnership with Nikola Corporation quickly faced challenges when allegations of fraud against Nikola surfaced, revealing fundamental issues that GM’s initial due diligence had missed. The partnership was significantly scaled back, highlighting the risks of relying solely on early evaluations without ongoing monitoring of external threats and partner stability.

This is where ongoing industry intelligence makes the difference—tracking risks over time ensures partnerships remain a competitive advantage, not a liability.

Track industry risks to keep partnerships on course

While a partnership may start strong, its long-term viability depends on how well it can withstand external pressures. Market conditions shift, regulations tighten, and industry competition evolves—introducing risks that weren’t apparent at the outset.

IBISWorld’s Risk Rating Reports provide a structured, objective assessment of:

- Structural risk: How an industry’s competitive intensity, cost pressures and business environment impact long-term stability.

- Growth risk: Whether an industry is positioned for sustained expansion or facing slowing demand.

- Sensitivity risk: How macroeconomic trends, regulation and funding changes could create volatility.

By integrating Risk Ratings into ongoing partnership reviews, executives can stay ahead of potential red flags—before they turn into costly missteps.

Final Word

The strongest partnerships are those grounded in strategic alignment and built to withstand changing conditions. They’re not just about short-term wins; they’re about making informed decisions that drive lasting value.

This principle is reflected in our own approach. Take our collaboration with Salesforce—by making industry insights readily accessible within a platform heavily-used by our clients, we've ensured that decision-makers have the information they need without disrupting their workflow. The value of a partnership isn’t just in what it provides, but in how effortlessly it supports business goals.

The same thinking applies when assessing potential partners. The right collaboration should strengthen decision-making, improve efficiency and create opportunities for long-term success. With data-driven insights, clear benchmarking and proactive risk tracking, IBISWorld helps businesses turn every partnership into a competitive advantage.