Despite a recent recovery, the US economy took a turn for the worse in the first quarter of 2022.

A widening trade deficit, facilitated by ongoing supply chain disruptions, and slowing inventory investment have pressured overall economic growth.

Consequently, real GDP has been adjusted to decrease at an annualized rate of 1.4% in the first quarter of 2022, marking the first decline since the start of the COVID-19 (coronavirus) pandemic.

Supply chain disruptions have been the main driver of declining GDP as inflation has continued to increase to 40-year highs while the United States continues to import goods to meet domestic demand.

As consumer spending, business investment and the unemployment rate have continued to improve, the Federal Reserve has maintained its plans to raise interest rates to temper the acceleration in economic activity.

However, this has intensified concerns of an impending recession.

Labor market

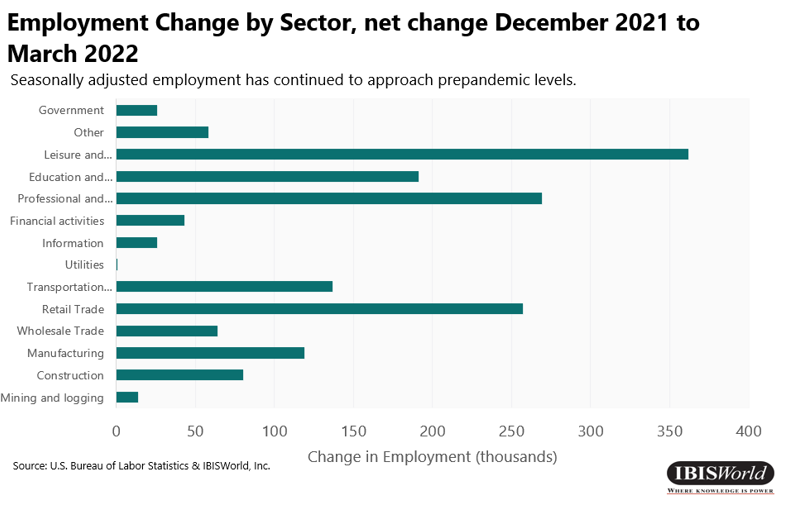

- The number of total nonfarm jobs increased 1.6 million in the first quarter of 2022, adding an additional 428,000 jobs in April alone.

- Job growth has been largely driven by a continued recovery from the pandemic, bringing the labor market towards its prepandemic level. However, job growth has varied across different sectors, making the mix of employment different than before the pandemic.

- The Leisure and Hospitality sector was the largest contributor to the growing employment, adding 78,000 jobs in April 2022. The Education and Health Services sector was the second-largest contributor to the growing employment, adding 59,000 jobs in April.

- Strong performance of the retail sector indicates that in-person retail employment has expanded, despite continued demand for nonstore retailing. This growth has largely been driven by continued consumer spending and easing pandemic-related restrictions.

- The average hourly earnings of all nonfarm employees increased $0.10 in April 2022. However, inflation-adjusted real average hourly earnings declined slightly due to continued inflation. Meanwhile, improvement in the unemployment rate is expected to slow as it approaches prepandemic levels.

Consumer spending

- Personal consumption expenditures (PCE) grew 3.8% during the first quarter of 2022.

- Year-over-year PCE increased 9.1% in March 2022. This growth in consumer spending has largely been driven by spending on non-durable goods, specifically on gasoline and other energy goods and food purchased for off-premises consumption.

- Spending on durable goods continued to increase during the first quarter of 2022, rising 5.4%. This increase was driven by large increases in furnishings and durable household equipment as well as recreational goods and vehicles.

- Spending on nondurable goods has also increased during the first quarter, driven primarily by spending on gasoline and other energy goods rising 19.3% during the same period. Additionally, spending on food and beverages purchased for off-premises consumption increased 4.0% during the first quarter of 2022.

- Lastly, increasing consumption of transportation services, which rose 4.7% during the first quarter of 2022, and recreation services, which grew 4.4% during the same period, drove spending on services to increase 2.7% during the first quarter.

Inflation

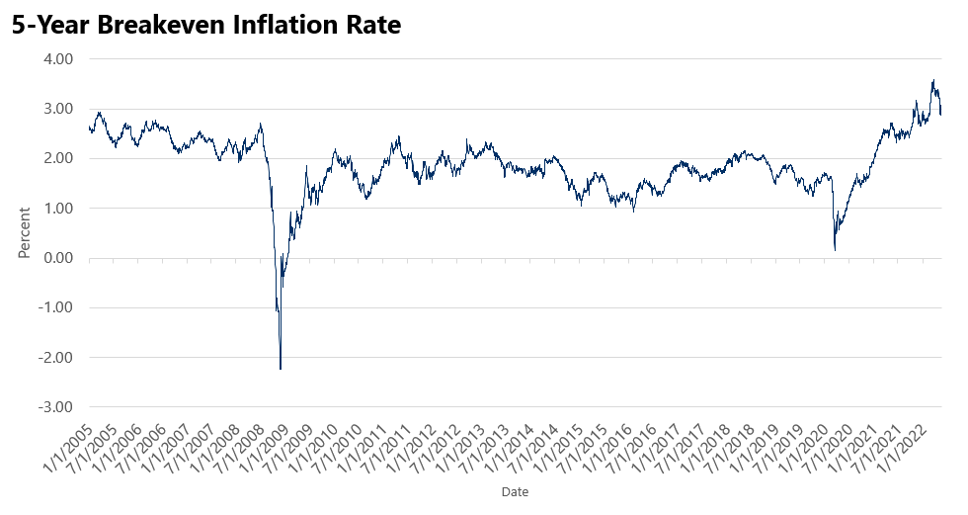

- PCE price index (excluding food and energy), the Federal Reserve’s preferred inflation measure, increased 1.1% in the first quarter of 2022. Consequently, year-over-year inflation stands at 5.2% for the year ending in March 2022, the largest increase since 1982.

- Although the Federal Reserve monitors multiple price indexes to measure inflation, it prefers core inflation measures that exclude volatile items such as food and energy items. Although these items can experience large prices changes during a given period, it does not necessarily mean their prices will follow that trend in the next period. Therefore, excluding these items is the preferred method of the Federal Reserve for assessing inflation trends.

- Inflation, as measured by the Consumer Price Index and including food and energy items, increased 8.5% for the year ending March 2022. Additionally, it increased 3.1% in the first quarter of 2022 alone.

- Ongoing supply chain issues caused by the coronavirus pandemic and the Ukraine-Russia War are the primary drivers for the spike in inflation. Pent-up consumer demand following the pandemic has caused limited supply, driving up prices. Additionally, the Ukraine-Russia War and the subsequent sanctions placed on Russia have caused energy and gas prices to increase sharply.

- To combat the historic rise in inflation, the Federal Reserve has, and is expected to continue to, aggressively increase interest rates in 2022.

Residential trends

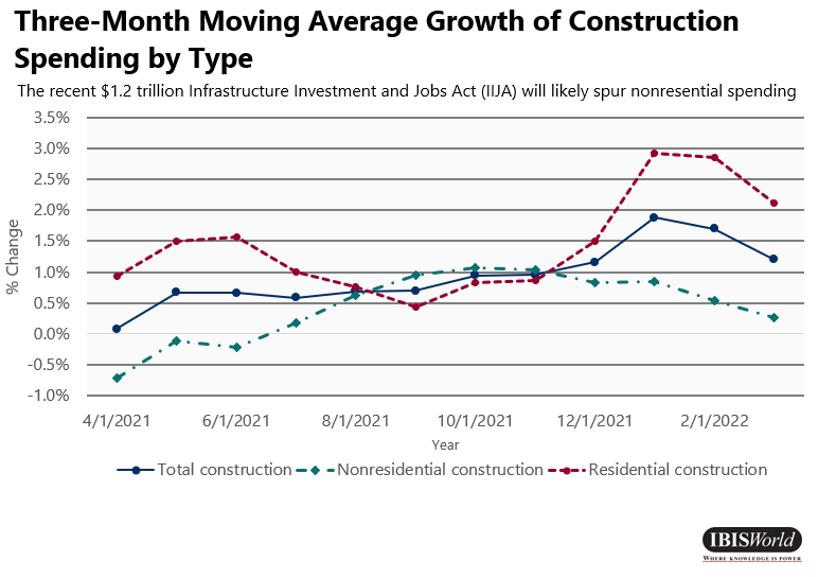

- The surge in housing prices has remained elevated in the first quarter of 2022, slightly accelerating compared with the fourth quarter of 2021. Capitalizing on this growth, new housing units’ construction remained strong, growing 6.3% during the quarter. However, interest rate hikes have increased the cost of borrowing for large construction projects, resulting in a slight deceleration compared with the previous quarter.

- Overall, construction of new homes has held up, with more than 1.5 million units under construction during the first quarter of 2022, remaining well above prepandemic levels as growth likely continues. However, new home sales plummeted in April 2022 as a result of high house prices in tandem with rising mortgage rates.

- Multifamily construction has continuously grown, partially due to end of urban flight and return of renters to cities as offices reopen. Strong demand rental units in cities while construction remains underway has driven up prices; for instance, rent prices in New York City, San Francisco, Los Angeles and Boston are at an all-time high.

- US mortgage applications have decreased as a result of rising mortgage rates, tempering demand for loans to purchase homes and refinancing activity. With more interest rate hikes to follow this year, this trend is continued to follow. However, The Mortgage Bankers Association (MBA) reported that its Market Composite Index, a measure of mortgage loan application volume, increased 2.5% for the week ending April 29, 2022, marking the first weekly increase in more than a month. Despite the growth, it is not expected to mark a long-term trend.

Nonresidential trends

- Nonresidential construction increased 0.8% during the first quarter of 2022, driven largely by manufacturing, conservation and development and public safety buildings. Manufacturing output has nearly returned to prepandemic levels, driving manufacturing construction to meet demand.

- Increasing manufacturing and industrial output amid economic recovery from the pandemic has contributed to rising construction activity for water supply and conservation equipment, which will service the ramp-up in capacity utilization. Additionally, recent interest rate hikes have encouraged utilities companies to replace outdated equipment. However, commercial and industrial loans have tempered, indicating a decline in investment in plant and equipment and working capital.

- The recent $1.2 trillion Infrastructure Investment and Jobs Act (IIJA) renewed funding for new and core programs, particularly for those to reduce carbon emissions, repair bridges, expand electric vehicle charging infrastructure and other large infrastructure projects difficult to fund by other means.

Financial markets

- Supply and demand imbalances alongside wage increases have continued to contribute to inflationary concerns. In response, the Federal Open Market Committee (FOMC) has started implementing aggressive rate hikes, the first of which began in March 2022. The Federal Funds rate increased twice in the first quarter and currently sits at effective 0.33%. These rate hikes are anticipated to continue in 2022 as the Russian invasion of Ukraine and pandemic-related lockdowns in China likely exacerbate supply chain issues. Additionally, the FOMC plans to reduce its balance sheet at an accelerated rate relative to previous forecasts

- While the market initially seemed resilient to the war in Ukraine and continued supply chain shortages in China continue, major indices took its biggest plunge since 2020. This is precipitated by the Federal Funds rate increasing 50 basis points on May 4th, 2022. With reduced liquidity in the market, volatility is anticipated to continue to increase until the Fed can reel in inflation and changes its monetary policy.

- Additionally, supply shortages occurred as production could not keep up with rapid demand increase, while constricted supply chains further pressured production. As a result, investors shifted to investing in precious metals, primarily gold, due to the volatile market.

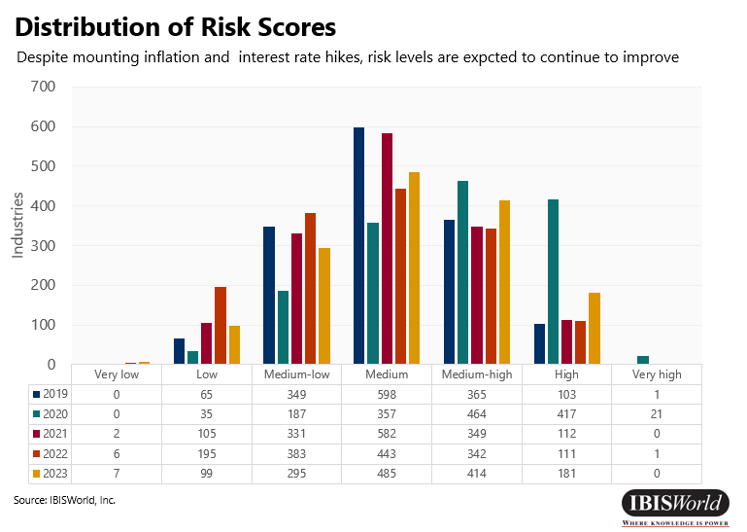

Distribution of risk ratings

- 2019 risk ratings were close to normally distributed.

- 7% of industries rated as medium-high or greater risk.

- Risk in 2020 was concentrated at the higher end of the scale due to the onset of the pandemic.

- 9% of industries rated as medium-high or greater risk.

- Risk in 2021 is expected to temper as restrictions largely ease.

- 1% of industries rated as medium-high or greater risk

- The risk outlook is expected to improve significantly in 2022, once the economy is fully reopened.

- 7% of industries rated as medium-high or greater risk.

Sector highlights

- Accommodation and Food Services – The Accommodation and Food Services sector went from the riskiest sector in 2020 to one of the least risky in 2022. This improvement was facilitated by the easing of regulations and consumer concerns that reemerged amid the onset of new variants of the coronavirus. Easing restrictions have facilitated growth in industries such as Chain Restaurants, Bars and Nightclubs and Single Location Full-Service Restaurants.

- Transportation and Warehousing – Following demand for transportation quickly rising in the previous quarter, the Transportation and Warehousing sector has continued to be a driver of economic growth. However, supply chain disruptions and rising fuel prices have increased costs for operators in this sector.

- Construction – Despite interest rate hikes in 2022 increasing borrowing costs for construction projects, funding from the IIJA is expected to drive nonresidential construction activity in 2022. In particular, the IIJA will likely benefit the Water and Sewer Line Construction; Road and Highway Construction; and Bridge and Elevated Highway Construction

- Retail Trade– Durable goods spending eased during the quarter, pressuring demand for key retail industries while consumers increased spending on nondurable goods. Rising gas prices have driven up revenue for the Gas Stations and Gas Stations with Convenience Stores industries, particularly as these establishments have passed on supply chain-related price hikes on to consumers. Rising food prices have driven up revenue for the Supermarkets and Grocery Stores industry while pressuring profit as establishments remain reluctant to pass on price volatility to consumers.