Key Takeaways

- Climate change has driven up the frequency and cost of natural disasters, and property insurers have responded by raising rates and pulling out of certain markets.

- Recent hurricanes that have hit the Southeast, such as Helene and Milton, have highlighted the tenuous state of the property and casualty insurance market.

- Businesses and individuals across the insurance market need to update their prior acts coverage on the risk of catastrophic weather to succeed in the coming years.

The 2024 hurricane season saw two major hurricanes – Helene and Milton – hit the Southeastern US. Though the final amount has yet to be tallied, it is clear that the storms caused tens of billions of dollars in damage. These are only the latest in a series of bills from weather-related disasters like high winds, flooding and wildfires that have been made more frequent and destructive by climate change. In addition, the insurance industry has struggled to adapt to a shifting risk environment that has disrupted the assumption of stability that underpins much of the property and casualty insurance market (for example, that “100-year floods” only happen once in a hundred years).

Insurers’ reaction to the new risk reality in recent years has resulted in general dysfunction. Average homeowners’ insurance premiums have skyrocketed, and many insurers have exited the riskiest markets because regulations have prevented them from raising rates in some states. In some cases, government insurers of last resort have stepped in to provide coverage. This operating environment has rendered the current insurance market a complex and dynamic field shaped by an array of factors, such as regulatory changes, technological advancements and evolving consumer demands.

Understanding insurance costs, for instance, is essential for businesses across various industries. These costs influence critical aspects of budgeting, risk management and long-term financial planning. For sectors prone to high levels of risk, such as manufacturing or construction, accurately projecting insurance expenses can safeguard against unexpected financial setbacks. Ultimately, the ability to effectively manage insurance costs can provide companies with a competitive edge and ensure sustainable growth.

Insurance prices

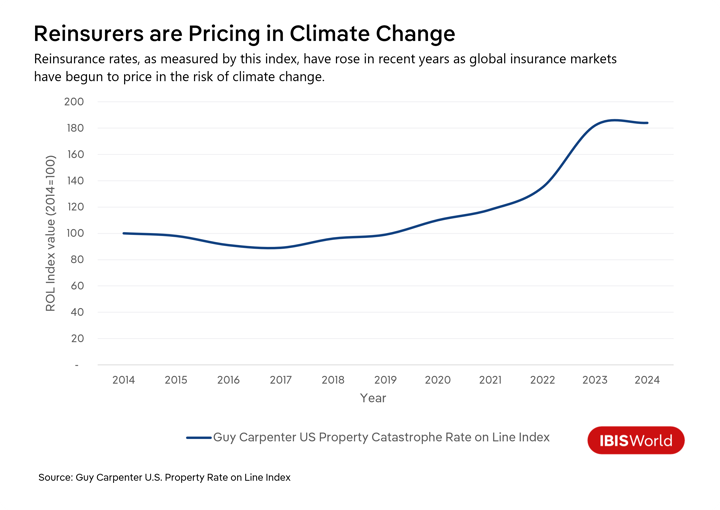

Reinsurance, often referred to as “insurance for insurance companies,” helps insurance companies manage risk by spreading it across multiple entities. Rising reinsurance rates have been a significant driver of increases in home insurance premiums in recent years – and states whose insurance markets rely more heavily on reinsurance, like Florida, have seen steeper cost increases. What’s more, state-level insurance regulation has caused price increases to be markedly different across different states, even among states that have similar exposure to climate change-related disasters. For example, this has meant that homeowners in Florida zip codes just south of the Georgia border have experienced significantly higher rate increases than their neighbors just over the border in Georgia, despite facing identical hurricane risk.

In contrast, California – which has experienced record-breaking wildfires in recent years – has not seen the same level of insurance rate increases. Since heightened wildfire risk led to significant property damage and economic losses for residents and businesses, one might assume rates would skyrocket. But again, the discrepancy comes down to state-by-state regulation: In California, strict regulations prevent insurers from raising rates too quickly. Insurers have responded by exiting the California market and by shifting costs to states with looser regulatory regimes, even if those states share the same rise in risk due to climate change.

The disparity highlights the delicate balance between regulation and risk management that insurers in different business sectors in the US must navigate. On one hand, companies in sectors with more stringent regulations and consumer protections may face challenges in adequately pricing risk and covering costs, potentially leading to underpricing and financial instability. On the other hand, companies in sectors with looser regulations could experience greater volatility as they seek to mitigate exposure to high-risk areas, resulting in significant cost fluctuations for consumers. Insurance companies must consider these regulatory environments when planning to ensure they can sustainably manage risks and provide coverage tailored to customers’ unique needs.

Impact on real estate markets

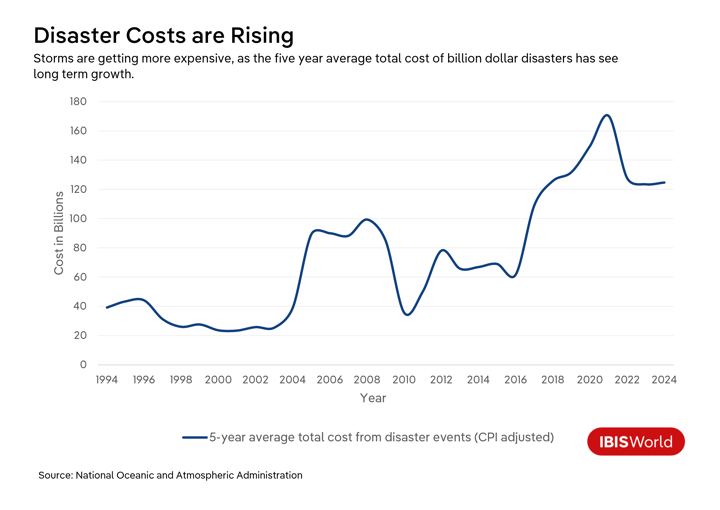

At issue is that skyrocketing insurance rates are entirely sensible given the escalating costs associated with climate change-related disasters – the frequency and severity of these events have been increasing significantly. In 2023, the United States experienced 28 disasters that resulted in damages exceeding $1 billion. By contrast, in the 1980s, the average was 3.3 such disasters per year, adjusting for inflation.

This increase in climate-related events has had isolated impacts on property values. The news media often features stories about adventurous individuals purchasing beachfront properties at bargain prices, despite the looming threat of erosion. However, overall, home prices have been on the rise in recent years and people seem reluctant to abandon hazardous areas, even if insurance companies have withdrawn their coverage.

Over the past two decades, the US government has had to rebuild certain real estate and housing structures as many as four times following disaster events. Despite this, the South has consistently experienced the most population growth in the last few years. Clearly, advising people not to live in Florida or other risk-prone areas is not a viable solution for the insurance crunch.

One of the reasons so many people are moving to the Southern states is that the region’s relatively low level of regulation enables the construction of more homes. For instance, after a spike in rents amid the COVID-19 pandemic in Austin, TX, a surge in housing construction followed that eventually led to a decrease in rental prices. Rents have been falling since May 2023, as reported by local news sources. By comparison, other cities with more strict regulations have struggled to achieve similar outcomes.

The construction of more housing is generally beneficial, particularly in addressing the longstanding shortage of housing in the United States and, more specifically, the shortage of affordable housing. However, while new housing developments are largely positive, they present challenges for insurers. Booming construction in disaster-prone areas has increased both the number and value of assets at risk, exacerbating the issue. As more properties are built in these vulnerable locations, the potential for significant financial loss due to natural disasters continues to rise, complicating the real estate market further.

Considerations for mortgage and loan evaluations in commercial banking

Enhance risk assessment with climate data

Since natural disasters are becoming more frequent and severe, traditional risk assessments may not capture the full scope of potential loss. Integrating climate risk data and predictive analytics into loan evaluations allows banks to identify properties at higher risk for damage from natural disasters. By leveraging data on flood zones, fire-prone areas and changing weather patterns, banks can make more informed lending decisions – and proactively adjust loan terms, insurance requirements or property types in high-risk regions.

Strengthen insurance requirement policies and verification practices

Given the rising costs and complexities in the insurance market, commercial banks must rigorously verify that mortgage borrowers carry adequate and up-to-date coverage. While stricter insurance requirements for loans involving properties in high-risk areas may be necessary, banks should recognize that coverage can be challenging to obtain in these regions due to limited insurer participation. In response, banks can work closely with borrowers to help them explore available options and maintain appropriate coverage levels. Routine insurance audits can further help reduce the likelihood of unanticipated losses and ensure that properties remain as fully insured as possible over the loan term.

Partner with resilience-building programs and offer incentives for property upgrades

Many property owners are unaware of options to fortify their properties against natural disasters. By partnering with government or local disaster resilience programs, banks can educate loan borrowers on improvements that minimize damage risk like reinforced building materials or floodproofing. Additionally, banks could offer rate reductions or other loan incentives for owners of properties that meet specific resilience standards, which would support community safety and protect bank investments by reducing the likelihood of loss on insured assets.

Considerations for real estate investment portfolios in investment banking

Invest in safer areas

In the US, regions such as the Great Lakes and New England are considered to be at relatively low risk from climate change-induced disasters like hurricanes, wildfires and extreme heat. These areas benefit from more stable weather patterns and less vulnerability to rising sea levels, which makes them potentially more attractive for long-term investments. Investors might find better opportunities for sustainable growth and security by focusing on these or other less climate-exposed regions.

Incorporate comprehensive climate and insurance risk assessments into due diligence

As insurance premiums soar and natural disasters become more frequent, incorporating climate and insurance risk assessments in portfolio evaluations is critical. Investment banks can use tools like climate modeling and predictive analytics to assess a property's long-term insurability and exposure to environmental hazards. This data-driven approach allows for more accurate property valuations and supports proactive decisions on whether to retain, adjust or sell high-risk assets.

Challenges for uninsured businesses and individuals

A lack of affordable property and casualty insurance has caused many people to go without it entirely. One estimate found that only 5.0% of the victims of Hurricane Helene had insurance coverage specifically for the kind of damage they suffered from the storm. This is because Helene caused more damage from flooding than wind; wind damage is more likely to be covered by home insurance, while flood damage typically falls under a separate flood insurance policy. Mortgage lenders generally require borrowers to have home insurance, so a homeowner is likely to be covered for wind damage to the home. The high cost of flood insurance, and perhaps the mistaken assumption that flood damage is covered by homeowners insurance, leads many to go without it.

Even those who do have flood insurance will likely have trouble rebuilding. Ninety-five percent of flood insurance policyholders in the US are covered by the National Flood Insurance Program, which has a $250,000 limit on covered damages. In addition, if a structure has lost more than 50.0% of its value due to flood damage, homeowners in some localities must pay out-of-pocket costs to bring their properties into compliance with floodplain management regulations. While the Federal Emergency Management Agency (FEMA) has stepped in to provide relief, homeowners’ bills are piling up.

Businesses operating without adequate insurance coverage are exposed to significant risks and vulnerabilities that can threaten their stability and continuity. One of the primary concerns is property damage from events like natural disasters, fires or vandalism. Without insurance, businesses have to bear the full cost of repairing or replacing damaged property, which can be financially devastating.

Another critical risk is loss of income during periods of downtime. For example, if a business is forced to close temporarily due to damage or another covered event, a lack of business interruption insurance would mean that lost revenue is entirely unrecovered. This income gap can strain cash flows, prevent the payment of ongoing expenses and potentially lead to insolvency.

Legal liabilities can incur monetary costs and affect a business’s reputation and client trust. In an incident where a business is deemed responsible for damages to a third party (such as customer injury or a breach in service agreement), lacking liability coverage means the business must cover legal fees, settlements or judgments out of pocket.

Collectively, these risks can hinder a business's ability to recover from adverse events, underscoring the importance of appropriate insurance coverage to protect against unforeseen losses and maintain operational resilience.

Strategies for success: risk management strategies for consultants

Develop tailored insurance procurement and cost containment plans

As certain coverage options become more limited and premiums rise, risk management consulting clients need tailored strategies to procure cost-effective insurance. Consulting firms can identify essential coverage needs, explore policy options across multiple insurers and negotiate premium rates that balance cost and protection. Additionally, advising clients on structuring deductible levels, coverage caps or self-insurance funds for high-risk assets can further optimize insurance costs without sacrificing critical coverage.

Guide clients on investing in resilience to lower insurance liabilities

Resilience investments are crucial for managing insurance costs in disaster-prone areas. Consultants can pinpoint specific upgrades – such as storm-resistant building materials, floodproofing and advanced fire detection systems – that reduce a property’s risk profile. Consulting firms can advise on resilience improvements that align with insurers' underwriting standards to help clients lower premiums, increase insurability and enhance long-term asset protection in high-risk markets.

Impact of insurance trends on construction

The latest trends in the insurance market are increasingly influencing the construction sector, shaping everything from material demand to labor requirements and overall project feasibility. As insurers adjust their policies in response to higher disaster risk, builders’ risk insurance and related policies are becoming more expensive and harder to acquire. This shift has direct consequences for construction companies, which must now account for higher insurance costs within their project budgets.

One source of rising costs has been the expanding use of solar panels, which can be damaged in shipping or the construction process and are sometimes covered by builders’ insurance. Higher premiums or limited coverage options can delay projects or force adjustments in materials and resources, slowing down timelines and adding complexities to already challenging construction environments.

Climbing construction costs (particularly in 2021 and 2022), paired with frequent delays, are also driving a rise in legal disputes and financial liabilities within this sector’s insurance industry. Project delays can lead to breach-of-contract claims, while unforeseen costs may push contractors and property owners into financial hardship, raising the likelihood of lawsuits. Legal professionals are seeing a greater need for involvement in contract negotiations and risk assessments as clients seek to balance elevated project expenses with risk management strategies. Insurance solutions, such as project-specific policies and enhanced liability coverage, are becoming essential tools for contractors to navigate these challenges while minimizing financial exposure.

To effectively manage these new pressures, the construction industry must adopt more strategic approaches to insurance. Working closely with insurers to understand policy details and assess risk management options allows construction firms to create proactive strategies that stabilize finances and protect against unforeseen liabilities. By embracing insurance solutions tailored to today’s high-risk climate, construction firms can mitigate potential losses, keep projects on track and maintain industry stability in an increasingly unpredictable operating environment.

Strategies for success for construction professionals

Strengthen insurance coverage and liability protections in contracts

Navigating the complex insurance market compels construction professionals to procure comprehensive insurance coverage that includes builders' risk, liability and natural disaster-specific policies. When drafting contracts, construction firms should work closely with legal counsel and insurance brokers to ensure that terms address potential delays, damage costs and liabilities arising from natural disasters. Contractors can reduce the chances of costly disputes and safeguard their financial interests – even if disasters or delays occur – by explicitly defining insurance responsibilities and risk allocations.

Adopt resilient design practices and embrace sustainable materials

Resilient design is becoming crucial for construction firms seeking to protect their assets and maintain insurability. Sustainable, durable materials and construction processes – such as reinforced concrete in hurricane zones or fire-resistant building materials in wildfire-prone areas – strengthen buildings and can improve project appeal to real estate investors while reducing insurance costs. Many insurers recognize the value of resilient construction and may offer premium discounts for projects built to sustainable practice standards, which helps firms manage costs while positioning their projects as reliable investments.

Final Word

Climate change has shaken the once stable foundation of property and casualty insurance, especially since the current and future risk environments have and will deviate significantly from historical trends. In 2024, hurricanes like Helene and Milton in the Southeast have put a spotlight on the widespread issue of climate change, as many people have struggled with the massive cleanup costs. Players from all corners of the global insurance market will need to plan for the coming costs of climate change, or they may wind up under water. Insurance companies have already begun to react to this new risk environment, e.g. raising rates where possible and exiting markets (or compensating by raising rates elsewhere) when regulations’ cap rate increases. It is up to consumers, businesses and regulators to likewise adjust to this novel reality.