Starting any business can be an arduous but exciting process for those passionate enough about the particular product or service they want to bring to market. However, in addition to coming up with a unique idea, most entrepreneurs must secure some financing, typically achieved through a loan. Banks handle most business loans, so these institutions need to assess the risk involved in each proposal carefully.

Fair lending

In addition to carefully assessing the risk involved in each loan, banks must adhere to certain fair lending laws, such as section 1071 of the Dodd-Frank Act. This section of the Dodd-Frank Act has amended the Equal Credit Opportunity Act (ECOA) by requiring financial institutions to collect and report more data on women-owned, minority-owned and small businesses. These data collection requirements are designed to help enforce fair lending laws and enable communities to focus on more opportunities for women-owned and minority-owned businesses.

Fast facts

Women-owned businesses are integral to the health of the U.S. economy.

The Good:

- Account for an estimated 42.0% of all US Businesses

- Employ approximately 9.4 million people

- Generate an estimated $1.9 trillion in annual revenue

The Bad

- Despite economic contribution, women-owned business experience significant hurdles

- An estimated 66.0% of women entrepreneurs reported that they have difficulty in obtaining the funding they need to succeed

- According to a 2019 study by Columbia Business School, female-owned businesses were 63.0% less likely to receive venture capital funding due to the continued biases

The winds of change

In response to the continued challenges endured by female entrepreneurs, many businesses, government agencies and other non-profit agencies have introduced a plethora of funds and grants. Some of these grants are also specially designed for minority-owned businesses. For example, BMO Harris Bank has recently launched a new Women in Business Credit Program, part of their five-year, $5.0 billion BMO EMpower commitment to expand access to affordable business credit for women and minority-owned businesses.

In addition, many other agencies have made different grants available for women and minority-owned businesses. Such grants include the Eileen Fisher Women-Owned Business Grant program, a small business grant program for companies making positive social and environmental impacts.

The Tony Burch Foundation's Fellows Program awards 100 grants to women-owned small businesses. Although the previous grants also apply to minority-owned businesses, several available grants directly help female minorities, such as The National Council of Negro Women's Grant. This grant gives funding opportunities for black women in business interested in starting their own company.

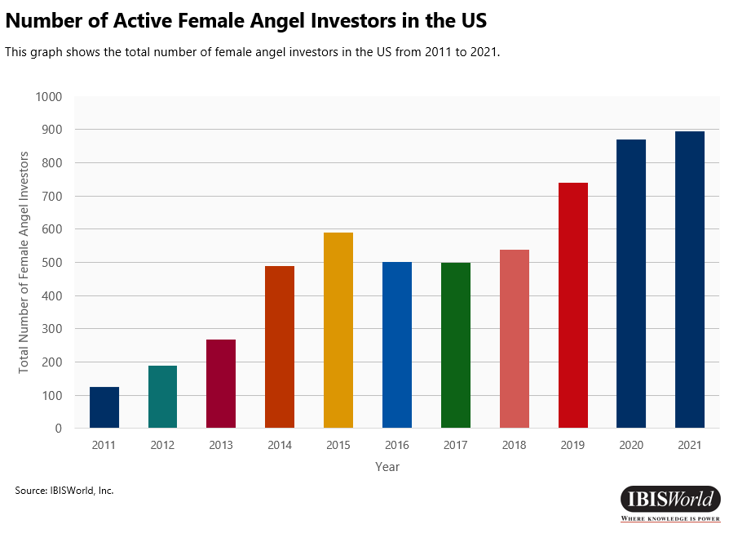

Consequently, certain industries have endured an increase in investments for female founders. Specifically, industries within the tech space endured more than $30.0 billion in investments throughout the first three quarters of 2021, an increase of more than 82.0% from 2020. This rise in investments can also be attributed to the largest growth in active female angel investors, which grew 66.0% from 2018 to 2021.

Sectors to watch

Since the percentage of women and minority-owned businesses has been on a steady upswing over the five years to 2022, lenders should continuously observe different sectors embracing women entrepreneurs to increase their profit margin.

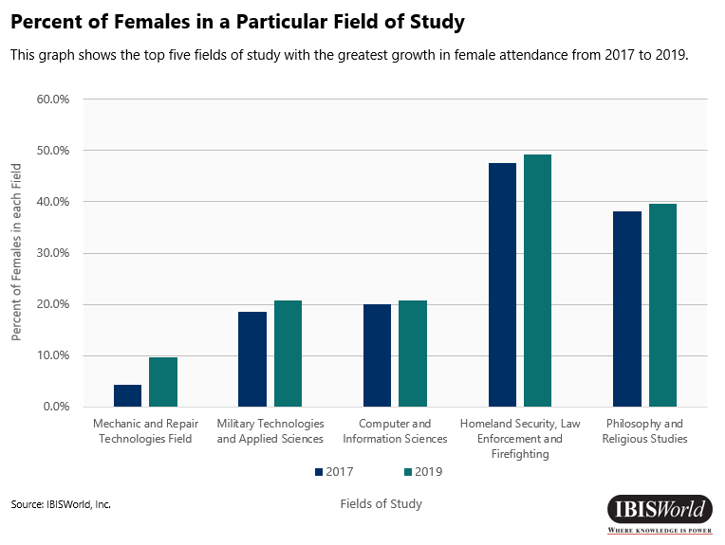

Some of the quickest growing sectors from 2014 to 2019 in the number of women-owned firms included utilities, construction, information, other services and arts, entertainment and recreation. These trends correspond with similar rises in the fields of study chosen by women. From 2017 to 2019, the largest increase of female participants was in the mechanic and repair technologies field, at an estimated 122.7% growth. The second-largest growth in female participants was in the military technologies and applied sciences field, at an estimated rise of 11.3% from 2017 to 2019.

Women-owned businesses have continuously proven successful and vital to the economy. As more women entrepreneurs continue to embark on different business ventures, investors would benefit from to take note.

As the funding gap continues to diminish and more grants become available, an increasing number of women will gain the confidence to start a business in a lucrative sector. Subsequently, as women leaders become more prominent in existing sectors, this will also motivate young women to enter emerging sectors, such as female technology (FemTech). FemTech companies focus on improving all women's wellbeing and are expected to gain significant traction over the five years to 2027.

As the funding gap contracts and gender-based biases subside, an emergence of women-owned businesses will enhance the country's economic prosperity. Wise lenders will take heed and drop unwarranted, unethical biases.