Key Takeaways

- Understanding key industry forces helps businesses develop strategies for resilience and competitive advantage.

- Factors like buyer power and market concentration directly impact profitability and strategic choices.

- Analyzing barriers to entry and substitute threats enables companies to identify opportunities and manage risks effectively.

What defines success in an industry? For many companies, it comes down to understanding the competitive forces that shape their landscape. Porter’s Five Forces model offers a foundational view, analyzing factors like competitive rivalry and buyer power. Yet some approaches go further, adding metrics like market concentration to capture a fuller picture of industry dynamics. By examining these elements, companies can better anticipate challenges, uncover opportunities and develop strategies that drive resilience and long-term growth.

How do competitive forces shape strategic planning?

Competitive forces, including market concentration, competition intensity, barriers to entry, threat of substitutes, buyer power and supplier power, play an important role in shaping a company’s approach to strategy. Here’s how understanding these competitive forces helps sharpen focus:

- Assessing industry dynamics: Analyzing competitive forces reveals structural factors that impact profitability and growth, showing where power lies and how it affects competition.

- Identifying opportunities and threats: Examining these forces reveals areas for differentiation and strengths to leverage, while also pointing to potential risks, like rising competition or shifts in consumer preferences.

- Informing strategic decisions: Insights from competitive forces guide choices in market positioning, product development, pricing and investment priorities, directing resources to areas with the most impact.

- Strengthening competitive advantage: By aligning offerings with market needs and barriers, companies can develop unique value propositions that are difficult for competitors to replicate.

- Building resilience: Factoring in competitive forces enables businesses to respond effectively to industry changes, technological advances and shifting customer demands.

1. Market Concentration

Market concentration indicates how much market share is controlled by the largest players in an industry. High concentration often means a few dominate, which creates stability but limits opportunities for smaller competitors. In contrast, low concentration reflects a fragmented market with many smaller players, which drives competition and innovation.

Factors that contribute to low market concentration

Low concentration is common in industries where there are minimal barriers to entry, frequent product innovation or where products have shorter life cycles. In these settings, new companies can enter more easily, leading to a larger number of smaller competitors. Fragmentation often occurs when established players reduce their focus on certain segments, allowing smaller companies to carve out niches.

For example, the Women's and Girls' Wear Manufacturing industry in Australia is highly fragmented, with the two largest manufacturers accounting for less than 20% of industry revenue. Many small boutique manufacturers focus on sustainable, niche garments, which allows them to compete effectively in a market with rising demand for eco-friendly and made-to-order fashion.

Factors that contribute to high market concentration

High concentration typically occurs in industries where large companies benefit from economies of scale, strong brand loyalty or high entry barriers. Established players can consolidate their position through acquisitions or mergers, reducing the number of competitors.

Additionally, in sectors requiring advanced technology, significant capital investments or compliance with stringent regulations, it can be challenging for smaller companies to enter and compete, leading to a more concentrated market.

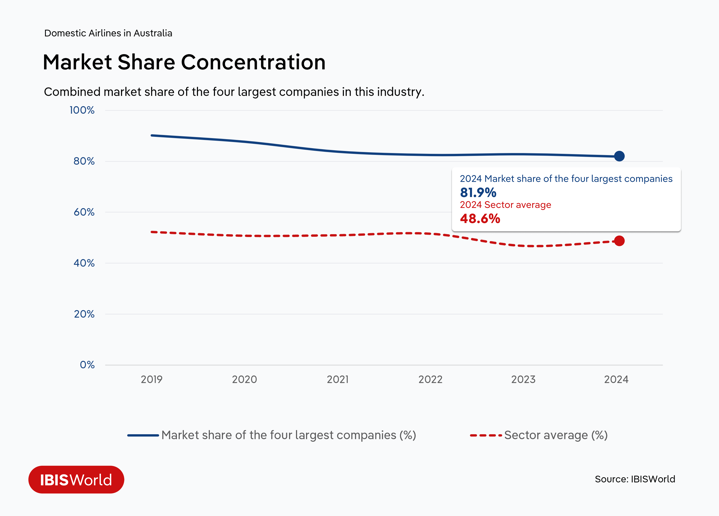

The Domestic Airlines industry in Australia, for example, is dominated by Qantas and Virgin Australia, which together account for more than 80% of industry revenue. High start-up costs, strict regulatory compliance and the need for significant capital investment make it difficult for smaller competitors to gain market share.

Competitive strategies

- Brand differentiation: In fragmented markets, developing a strong brand identity helps businesses stand out. Establishing a clear and unique value proposition can attract and cultivate loyal customers, even in an industry crowded with competitors. For example, Apple’s emphasis on innovation and premium quality has differentiated it in the electronics market, helping it build a dedicated customer base.

- Niche targeting: Focusing on specific customer segments or underserved niches allows companies to carve out a unique space. By specializing in areas with particular customer needs, businesses can build loyalty and reduce direct competition. Lululemon’s focus on high-quality, yoga-inspired athletic wear, for instance, has allowed it to create a loyal following within a specific fitness niche.

- Strategic Consolidation: In concentrated industries, established companies can pursue acquisitions or partnerships to expand their market share and leverage economies of scale. This strategy strengthens a company’s position and creates additional barriers for new entrants, evident in Disney’s acquisition of Pixar, Marvel and Lucasfilm. These acquisitions have expanded Disney’s entertainment empire, reinforcing its dominance in the media industry and creating barriers for smaller studios.

2. Competitive intensity

Competitive intensity describes the level of rivalry among companies within an industry. High competition puts pressure on businesses to differentiate, cut prices or improve offerings to retain market share, which can squeeze profit margins. In industries with low competitive intensity, less direct rivalry means companies benefit from steadier pricing and higher profitability.

Factors that drive high competitive intensity

High competition arises in industries with many similar products, low switching costs for customers and high pricing transparency. When consumers can easily compare options and switch providers without much hassle, companies must work harder to retain their customer base, often resorting to aggressive pricing tactics, increased marketing or frequent product updates. Saturated markets with few points of differentiation are particularly prone to intense competition.

For example, the UK Pubs and Bars industry faces high competitive intensity, with establishments competing on price, food and drink quality, and atmosphere. External competition from nightclubs, restaurants and even cafes add further pressure, forcing pubs and bars to diversify and continually adapt to changing consumer preferences.

Factors that drive low competitive intensity

Industries with low competitive intensity tend to have fewer players, high differentiation between products or strong customer loyalty, which reduces the pressure to compete aggressively. High switching costs, long-term contracts or specialized offerings can also reduce competition by making it harder for customers to shift between providers.

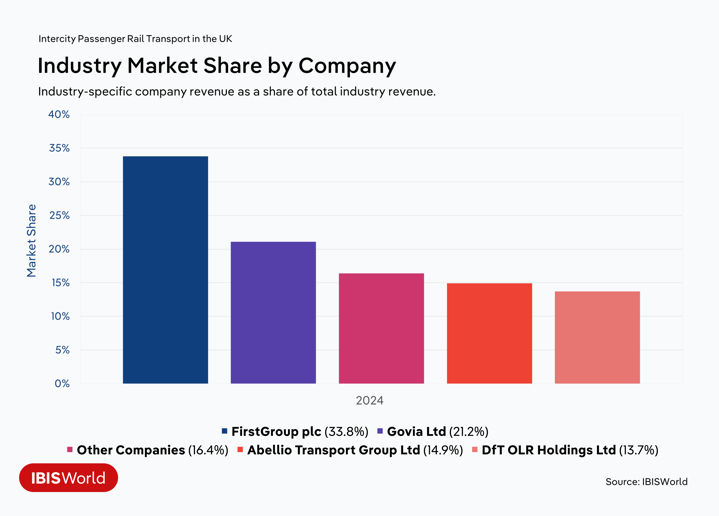

In the UK Intercity Passenger Rail Transport industry, for instance, the way contracts are awarded limits competition. Only larger Train Operating Companies (TOCs) qualify for major franchises, and once contracts are secured, these TOCs hold a monopoly over specific regions, which minimizes direct competition and maintains steadier demand.

Competitive strategies

- Operational efficiency: In highly competitive environments, optimizing operations to reduce costs is critical. By streamlining processes and cutting unnecessary expenses, companies can maintain profitability even when intense competition pressures prices. Walmart’s focus on operational efficiency, for example, allows it to offer consistently low prices, giving it a competitive edge in the retail market.

- Unique customer experience: Offering an exceptional customer experience can set a company apart in a crowded market. Businesses that focus on personalized service, responsive support and a seamless user journey can create loyal customers who are less likely to switch based on price alone. For instance, Ritz-Carlton is renowned for its exceptional customer service, which has created a loyal customer base willing to pay premium prices for its distinctive experience.

- Product differentiation: Introducing unique product features or innovative designs helps companies stand out in competitive markets. When products have clear, compelling differences from competitors’ offerings, businesses are less reliant on price alone to attract and retain customers. Dyson’s innovative vacuum technology and design demonstrate this strategy, setting the company apart from other appliance manufacturers and helping it capture a loyal customer base.

3. Barriers to entry

Barriers to entry refer to obstacles that make it challenging for new companies to enter an industry. High barriers limit new competition, protecting established players, while low barriers allow for more new entrants, heightening market competition.

Factors contributing to high barriers

Industries with high barriers to entry typically involve stringent regulatory requirements, high start-up costs and significant capital investments. This is the case in the Semiconductor Machinery Manufacturing industry in the US, in which prospective entrants face substantial legal and capital barriers. Since the industry involves handling toxic chemicals, entrants must comply with strict environmental and safety standards. They must also avoid infringing existing patents, which large incumbents protect aggressively. Additionally, start-up costs are extremely high in the industry, as semiconductor machinery requires specialized tools and software with precise tolerances. This need for advanced technology and substantial investment makes it difficult for new competitors to establish themselves.

Factors contributing to low barriers

Low barriers to entry are common in industries with minimal regulatory oversight, lower capital requirements or technology that reduces start-up costs. In the Electricians industry in the US, for example, obtaining an electrical license and following local codes are relatively manageable legal requirements. Differentiation in this field primarily depends on service quality and pricing, both of which are accessible to new entrants, allowing for easier market entry.

Competitive strategies

- Continuous innovation: Established companies in industries with high entry barriers can continually innovate to maintain their advantage. By investing in R&D, enhancing product quality or expanding into new areas, businesses create additional layers of protection against potential new entrants. The pharmaceutical giant Pfizer, for example, invests heavily in R&D to develop new drugs, maintaining its competitive edge amid strict regulatory barriers.

- Partnerships and alliances: Forming partnerships with other firms can help companies in high-barrier industries strengthen their competitive position. Established players that share resources and expertise can expand their market reach and reinforce their position in the face of evolving industry standards or technological advancements. For instance, Starbucks has partnered with DoorDash to integrate delivery services into its app, enhancing customer convenience and expanding its reach.

- Scalable business models: To thrive in industries with lower entry barriers, companies can adopt scalable business models that allow them to quickly adjust to market changes and grow alongside increasing competition. Businesses that develop flexible, adaptable operations can capture new opportunities and respond rapidly to shifts in demand. For example, Uber’s scalable platform enables it to expand into new cities and adjust its operations based on local demand, enhancing its competitiveness in the ridesharing industry.

4. Threat of substitutes

The threat of substitutes refers to the potential for alternative products or services to fulfill the same customer needs, which can reduce demand for a company’s offerings. When viable substitutes are readily available, companies face increased pressure to compete on factors like price and quality to retain customers. In contrast, industries with few or no direct substitutes exhibit greater market stability and reduced competitive pressure.

Factors contributing to a high substitute threat

A high substitute threat typically exists in industries where alternative products or services meet customer needs similarly in terms of quality, cost or accessibility. In these cases, customers have options that can satisfy their requirements, increasing the likelihood that they may switch.

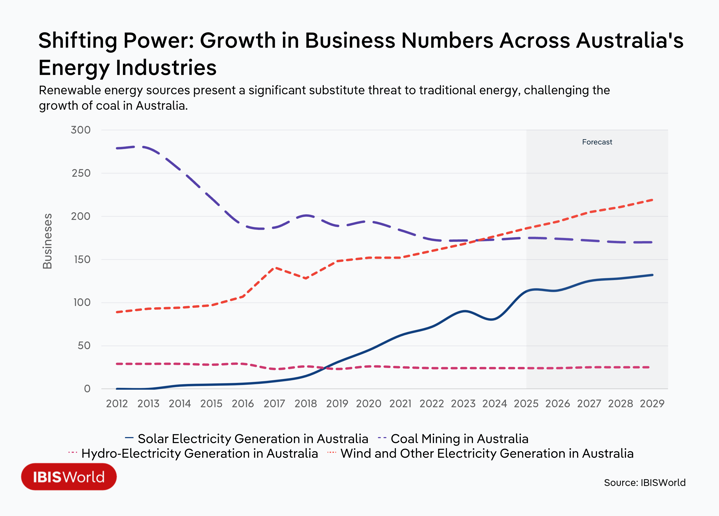

For example, in the Coal Mining industry in Australia, renewable energy sources like solar, wind and hydroelectric power present a significant substitute threat. These alternatives offer cleaner energy solutions, reducing reliance on coal and pushing the industry to compete on cost and environmental impact. As renewable energy becomes more available and is increasingly adopted, pressure is intensifying on coal miners to adapt in a rapidly changing energy market.

Factors contributing to a low substitute threat

Substitute threats are low in industries with highly specialized or essential products, where alternatives are limited or nonexistent. In such markets, customers have few options outside of the primary offering, resulting in stable demand and less competitors offering substitutes.

For example, in the Funeral Directors, Crematoria and Cemeteries industry in Australia, there are few viable substitutes for end-of-life services. Body donation to science is one substitute option, but this alternative has seen declining interest as medical advancements reduce demand for anatomical donations. The essential and culturally significant nature of funeral services contributes to a low substitute threat in the industry.

Competitive strategies

- Product differentiation: Companies can develop a unique value proposition to mitigate the impact of substitutes. By focusing on distinct qualities, they can attract loyal customers and make their products less easily replaced by alternatives. For example, Patagonia differentiates itself in the outdoor apparel industry with a strong commitment to sustainability and ethical sourcing. This approach makes its products more enticing to environmentally conscious consumers and reduces the appeal of conventional clothing brands as substitutes.

- Customer education: Informing consumers about a product's unique benefits and qualities can foster loyalty and make them less likely to switch to substitutes. Whole Foods employs this strategy, educating customers on organic and sustainably sourced products, which makes them less likely to buy conventional alternatives.

- Investment in innovation: Companies that continually improve and expand their product offerings can stay ahead of substitute threats. By innovating and adapting to customer needs, businesses can strengthen their market position and lessen the impact of competing products. Netflix, for example, consistently invests in new content and personalized recommendations to keep subscribers engaged and make competing streaming services less appealing.

5. Buyer power

Buyer power refers to the influence that customers have over a company’s pricing, product quality and business practices. High buyer power allows customers to demand lower prices or higher quality, constraining companies’ profitability, while low buyer power gives companies greater control over pricing and product offerings.

Factors contributing to high buyer power

High buyer power typically arises when a small number of buyers control a significant share of purchases within an industry. Buyers have increased leverage when they account for a large portion of sales, can easily switch providers or can negotiate prices due to their purchasing volume. Additionally, buyers gain power when they have clear alternatives, which puts pressure on companies to meet specific demands or lower prices to retain business.

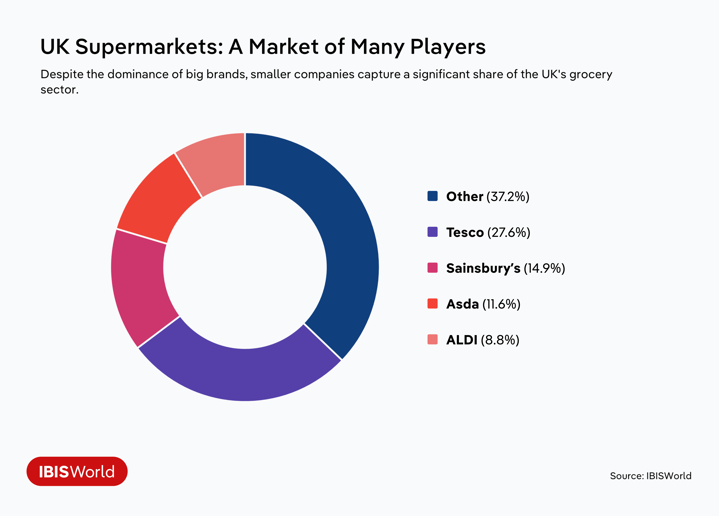

For example, in the UK Supermarkets industry, buyers are highly price-sensitive and have numerous options, from large supermarket chains to discount retailers and smaller independent stores. Since alternatives are widely available, consumers can easily compare prices and switch between providers, forcing supermarkets to compete aggressively on price and quality to attract and retain customers. This variety of choices enhances buyer power, as supermarkets must continuously respond to consumers’ demands to maintain market share.

Factors contributing to low buyer power

Low buyer power occurs in industries where customers have few choices or limited alternatives to the product or service offered. When buyers lack viable substitutes, companies can maintain higher prices and have greater control over terms. Additionally, when a large number of small buyers purchase from an industry, their individual influence on pricing and business practices is diminished.

For instance, in the UK Gas Distribution industry, households and businesses have no choice in selecting their gas distributor, as each of the eight distribution networks operates as a regional monopoly. This lack of alternatives limits buyers’ influence, although regulatory bodies like Ofgem and NIAUR oversee the industry to protect consumers from excessive pricing.

Competitive strategies

- Build strong relationships: Companies that develop strong, long-term relationships with customers reduce buyer power. By enhancing trust and reliability, they can create loyalty that reduces customers’ motivation to seek alternative providers. For example, Woolworths uses its Everyday Rewards program to incentivize customer loyalty, offering points that can be redeemed for discounts and special deals, which helps retain customers in a fiercely competitive supermarket landscape.

- Value-added services: Offering additional services or tailored solutions can differentiate a company’s products and reduce buyers’ bargaining power. When customers perceive unique value beyond the core product, they're often less inclined to push for lower prices. For instance, Amazon provides added value through services like Prime, which offers faster shipping, exclusive content and discounts, encouraging customer retention and reducing price sensitivity.

- Expand customer case: Diversifying the customer base reduces dependency on large buyers. By reaching smaller or new buyers, companies can minimize the influence of any single buyer and maintain greater control over pricing and terms. Nike has taken up this approach, offering customizable products online to expand its reach to a broader customer base. This strategy appeals to individual consumers as well as team orders, lessening the company's reliance on large retail chains.

6. Supplier power

Supplier power is the influence that suppliers hold over the price, quality and availability of materials essential to a company’s operations. High supplier power can drive up costs and limit companies’ profit margins, while low supplier power offers companies more flexibility in sourcing.

Factors contributing to high supplier power

High supplier power typically occurs when there are few suppliers of essential materials, limited alternatives or when specific inputs are difficult to replace. Supplier power increases when materials are critical to production and in situations where industrywide trends, like consolidation, reduce the number of available suppliers.

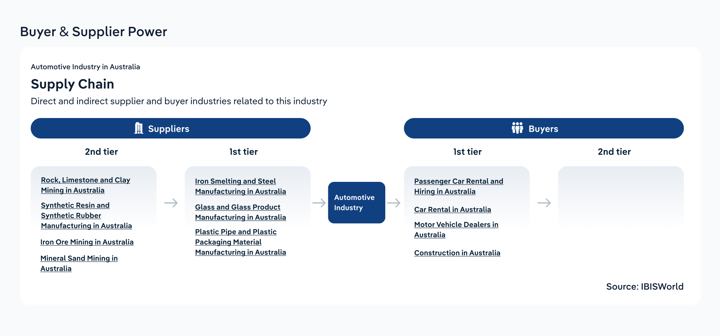

In the Australian Automotive industry, since domestic car manufacturing ceased, companies rely heavily on imported components from specific suppliers, which augments these suppliers’ bargaining power. This reliance on key materials and components makes the industry vulnerable to supplier demands and price increases, impacting production costs and flexibility.

Factors contributing to low supplier power

Supplier power is low when there are many suppliers, readily available alternatives or low switching costs. When companies can source materials from a broad range of suppliers, they gain greater bargaining power and flexibility.

In the Australian Health Snack Food Production industry, for instance, suppliers of fruit, nuts, grains and other ingredients are highly fragmented, intensifying price competition and weakening individual suppliers’ bargaining power. Even though environmental factors like droughts or floods can impact the availability of these ingredients, the overall abundance of suppliers ensures that their power remains limited.

Strategic approaches

- Supplier diversification: Establishing multiple sourcing options can reduce dependency on a single supplier, mitigating supplier power. This approach enables companies to maintain stable supplies, negotiate better terms and insulate against potential shortages. Toyota employs this strategy by sourcing parts from a network of suppliers worldwide, which helps the company reduce risk and maintain production stability, even if one supplier faces disruptions.

- Long-term contracts: Securing long-term agreements with suppliers can stabilize prices and ensure consistent material availability. By locking in terms, companies can minimize the effects of market fluctuations and supply disruptions. Companies like McDonald's, for instance, often lock in multi-year contracts with food suppliers to keep prices steady and secure a reliable supply.

- Vertical integration: In some cases, companies may choose to integrate parts of their supply chain to reduce reliance on external suppliers. Bringing certain production stages in-house enables businesses to gain greater control over raw material availability and costs. For example, IKEA has invested in its own forestry operations to secure raw materials for its furniture production, giving it control over wood supply and reducing its dependency on third-party suppliers.

Final Word

Understanding and strategically responding to industry forces is essential for sustained success. By analyzing market concentration, competitive intensity, barriers to entry, substitute threats, buyer power and supplier power, companies can strengthen their position, identify opportunities and navigate industry challenges with resilience. Leveraging these insights helps businesses protect their market position while continuously adapting to industry changes.