“The IBISWorld industry data is dynamic and frequently updated.”

“All of the industry information I could ever think about needing is right in one place.”

“I would definitely recommend IBISWorld. The company’s thorough, up-to-date industry coverage is always in-depth, yet easily accessible.”

Banks and credit unions must be able to make informed lending decisions as the financial landscape evolves. Farmers State Bank, a longstanding institution with a rich history dating back to 1910, is no exception. With its deep commitment to personal service and a warm, family-like atmosphere, Farmers State Bank of Alto Pass serves the Southern Illinois community with dedication and care.

Farmers State Bank recognizes the importance of staying ahead of industry trends, accessing up-to-date and relevant industry data, and having efficient tools at their disposal. It was in pursuit of these objectives that the bank turned to IBISWorld.

Through the eyes of Katie Barter, a credit analyst with over 20 years in the field, we gain insight into the bank's experience, and how IBISWorld's industry data has become an indispensable asset in the completion of credit presentations.

Join us for a recap of our recent discussion with Katie to learn how Farmers State Bank uses industry data to make confident lending decisions, create lasting financial stability, and build stronger client relationships.

Part 1: The challenge

A credit analyst's role is integral to maintaining the financial health of a bank. This responsibility is one that grows even more important when discussions of financial crisis are all around.

This is the setting for our talk with Farmers State Bank. With a string of bank failures in the rear-view mirror and interest rates soaring to new heights, banks are doing a delicate dance to stay prosperous despite these challenges.

A higher level of scrutiny for loan applicants can shrink the pool of qualified borrowers, making it more important than ever to offer top-tier service and other perks that attract clients.

Part 2: The solution

Working through loan applications quickly and efficiently can be a big differentiator for banks that are looking to stand out.

At Farmers State Bank, Katie Barter is a master at using all resources at her disposal to research, evaluate and present her findings in a timely fashion.

Here’s where Katie turns for help:

Executive summaries simplify the task of gathering industry data during the analysis process. Katie frequently relies on IBISWorld's Executive Summary section to obtain quick, concise insights into various industries. These summaries, typically spanning three to four paragraphs, serve as a valuable resource when crafting credit presentations.

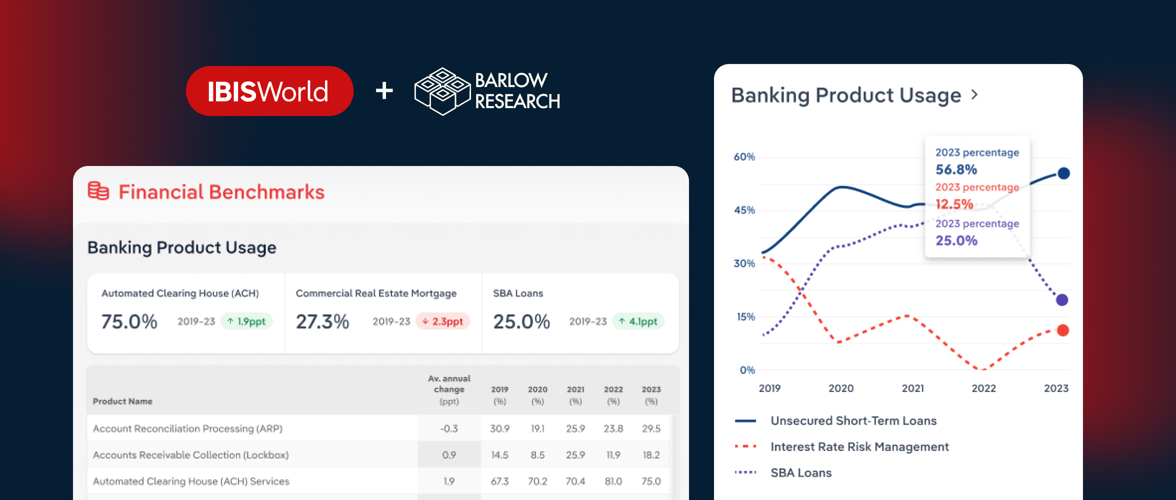

Benchmarking tools support comparative analysis. IBISWorld's Segment Benchmarking product is another indispensable tool on which Katie heavily relies. By zooming in on the exact segment of the industry where a client operates, she can conduct in-depth comparative analyses that show her precisely where a client stands in the context of peers. Having this data at her fingertips has motivated Katie to create a Segment Benchmarking table template. The tables in this template illustrate industry versus company data.

Early Warning System makes proactive decisions possible. IBISWorld's Early Warning System keeps the bank informed about industry trends, empowering them to make proactive decisions and address potential risks. Using this tool has allowed Katie to develop a quarterly data compilation table. The spreadsheet summarizes the bank’s top number of loans by NAICS code. This data is compared to IBISWorld risk categories and directions of risk.

Local data makes FSB the expert on niche and unfamiliar industries. Katie recalls a time-sensitive situation where IBISWorld played a pivotal role in delivering localized data. When the SBA department urgently needed specific industry data for a hotel in Florida, Katie was able to swiftly deliver.

“I was able to drill down using IBISWorld – quickly and efficiently – to provide the specific data on Florida’s hotel industry, along with data for the county,” remembers Katie. “To me, that is unprecedented,” she adds.

Part 3: Why IBISWorld?

Farmers State Bank came to IBISWorld in 2016, upon Katie’s recommendation. The unique product mix that’s tailor-made for banks has delivered success to Katie and her colleagues time and time again.

When reflecting on the bank’s decision to onboard IBISWorld, Katie highlights four instrumental benefits:

1. Time savings

One of the standout benefits of using IBISWorld is the unparalleled efficiency it brings to the process of accessing industry data. Through the platform, Katie and her colleagues can quickly obtain the specific information they need to make informed lending decisions. The time saved in data retrieval and analysis has been substantial, enabling the bank to serve their clients more promptly and efficiently.

2. Streamlined data

IBISWorld's data is designed with banks in mind. With industry insights already prepared in familiar formats for credit analysts, Katie can create comprehensive industry summaries for credit presentations without the headache. The ability to access detailed industry insights and refine them into clear, concise reports has not only improved the quality of service provided by Farmers State Bank but also their efficiency. Not to mention, the clarity and depth of these reports contribute to a more informed decision-making process.

3. Frequent updates

Outdated data serves no purpose in the banking world. Fortunately, IBISWorld puts up-to-date industry statistics in the hands of credit analysts like Katie. “I feel like the IBISWorld industry data is dynamic,” she says, “meaning that it's regularly updated – and frequently updated, really.” It’s the timeliness of data that makes all the difference for the bank when navigating high stakes lending decisions and balancing the bank’s financial health with the interests of their clients.

4. Great customer service

The support offered by the IBISWorld team has proven to be another invaluable benefit. The responsiveness and timeliness of customer service have been particularly noteworthy. Whenever Katie or her colleagues have questions or require assistance, the IBISWorld team is readily available to provide informative and helpful responses. This level of support ensures that Farmers State Bank can fully utilize the platform and make the most of its resources.

In closing, Katie emphasizes that “IBISWorld helps us stay informed and remain relevant through data, uncompromised.”

These benefits collectively underscore the tremendous value that IBISWorld brings to Farmers State Bank.

Part 4: A future with IBISWorld

With measured success for their credit analysts, Farmers State Bank will emphasize IBISWorld’s platform to their team of lenders next. Recognizing that industry data has the potential to boost client meeting prep, the time is right to extend access across the bank.

In a climate where qualified borrowers can be hard to find and intense competition looms, being able to speak knowledgeably about the challenges within a borrower’s industry can be the assurance they need to choose one bank over the next. Educating lenders on the ins and outs of the industries they serve helps foster longer-lasting relationships as commercial clients come to view their lenders as trusted advisors.

As the team gears up for this initiative, IBISWorld's unmatched data integrity and comprehensive industry coverage are poised to be instrumental in Farmers State Bank's journey toward sustained competitiveness and relevance.

Entering her eighth year at Farmers State Bank, Katie is thrilled to continue helping the bank succeed in its mission to provide the highest quality financial services to their communities.

To learn more about Farmers State Bank and their offerings, visit their website.

If you're interested in sharing your success story with the IBISWorld team, please email customersuccess@ibisworld.com to start the discussion!