Canada's economy is maintaining at a high level, with real GDP up in Q1 and Q2 by 0.4% and 0.5%, respectively. More consumer spending and higher employment figures are helping the Canadian economy stay ahead. Inflation numbers are still elevated but declining year-over-year (YoY), presenting an opportunity for the economy to scale up again effectively. While interest rates were high in the period, they began scaling down with a rate cut in June 2024. However, issues remain, such as rising unemployment numbers, slumping nonresidential construction investments and certain goods remaining pricey, adding enough pressure to keep the Canadian economy from fully rebounding.

Labour market

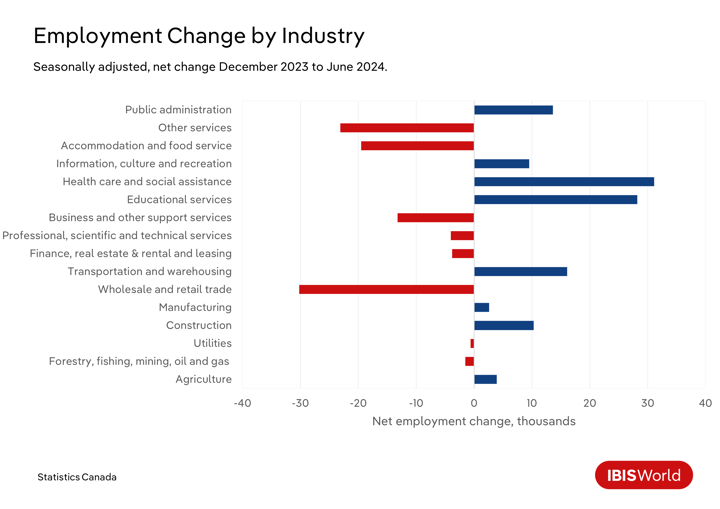

- Canada's employment numbers are improving, going up 0.9% in the first half of the year as health care and social assistance; and business, building and other support services rallied the most job gains in the period.

- However, the unemployment rate was at 6.4% by the end of the period, a gain of 0.7% from the start of the year. Layoffs and slow job gains in specific sectors and straight-up losses in others mainly cut down on employment numbers, keeping many looking for jobs during the period.

- Sectors like information, culture and recreation and construction lost steam in the period, as both lost jobs in the first half of the year. Factors like tech layoffs and volatile economic developments hurt their bottom lines in the period, making hiring harder when costs remain a significant factor on businesses day-to-day.

- Average hourly wages, measured in current dollars, went up 0.5% from December 2023 to June 2024, as modest efforts to expand wages are underway while labour unions are still at the negotiating table, giving their members much more representation.

Consumer spending

- The household consumption expenditure (HCE) in Canada had a robust period, up 4.8% in H1 2024 from last year. This is a sign that spending is still happening despite stubborn inflation.

- Spending on housing, water, electricity, gas and other fuels accelerated the most in the period, but it also rose for transportation, recreation and culture. This reflects the mix of essential and nonessential spending happening in the period.

- But, spending fell for alcoholic beverages, tobacco and cannabis and on furnishings, household equipment and other goods for the first half of the year. These items struggle to attract consumers as they have become harder to sell because of health concerns or their high price tags.

Inflation

- The consumer price index, including food and energy items, went up 2.7% in June 2024 from June of last year, a clear sign that inflation data is still recovering.

- The price of clothing and footwear and household operations, furnishings and equipment prices are down 3.1% and 0.9%, respectively, making the case that inflationary pressures for certain items are not as bad as they previously were last year.

- But food prices and shelter costs show a different picture, with both going up YoY in June 2024 by 2.8% and 6.2%, respectively. Various factors like inflation and the housing affordability crisis in the country amid low housing stock are now making these expenses higher and difficult for consumers to bear.Gas prices have also risen by 12.6% from January to June 2024, as more have turned to gasoline as an energy source amid lower electricity generation and greater crude oil exports.

- Aside from food and energy goods, inflation went up 2.9%, with shelter costs driving much of these expansions in costs for the economy, making this expense a significant issue for the country.

Residential construction

- Residential construction had made progress. Investments in such projects went up 1.7% from December 2023 to June 2024 as efforts to address housing needs amid the rising population have impacted housing activities.

- However, costs are scaling up for residential construction by 1.0% and 0.8% in Q1 and Q2, respectively. Issues bringing down interest rates and the impacts of high labour costs are making it harder for costs to come down in the period.

- There is a very slight recovery in the five-year conventional mortgage rates, standing at 6.8% by the end of June 2024. This is a slight recovery from early January of the same year when they were at 7.0%, as economic circumstances are beginning to improve from the Bank of Canada making interest rate cuts starting in June.

Nonresidential construction

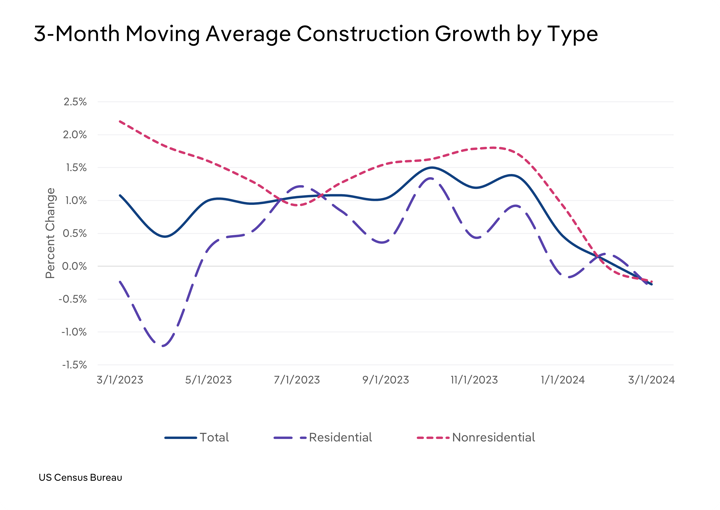

- Volatility persists for nonresidential construction as spending on these projects fell 0.5% in the first half of the year; it went up 2.1% from June 2023 to June 2024, signaling an unclear picture of this market as various downstream sectors recovered in the period.

- Institutional nonresidential construction spending climbed 12.3% YoY in June as the need for more infrastructure remains a top concern in the country, especially with various initiatives supporting these endeavors, like the Investing in Canada Infrastructure Program.

- Commercial nonresidential construction spending lost stream by 3.8% in June as office spaces remained empty. The prolonged pacing of construction on data centers in the country is not helping scale up this sector as it should, especially as these projects stay up in the air while the need for certain buildings impacts where investments are going.

- But these investment shifts are lifting certain types of commercial nonresidential projects, like mixed-use developments. Various retail facilities and locations are also preventing this segment from losing too much steam.

Financial markets

- In a dramatic shift in policy, the Bank of Canada cut rates in June 2024, a close reflection of where the economy sits as inflation begins to ease.

- As these conditions improve in the economy, the expectation that interest rates will start to normalize has kept the market on edge. As inflation data improves, balance sheet normalization practices will remain the key objective of the Bank of Canada.

- The stock market has seen better days. The S&P/TSX Composite suffered a 1.3% loss in the second quarter of 2024. Only two sectors reported a positive return during the period (Materials and Consumer Staples), a worrying sign that sectors are losing steam.

- However, on a YTD level, the S&P/TSX Composite was much better, going up by 4.4% in the year's second quarter. This also suggests that, on a yearly level, the stock market is still riding the wave of an economic boost.

Macro outlook

The macroeconomic environment will still be recovering during this period. Inflation will be a concern, keeping this economic data in flux as this influences how the Bank of Canada will respond. While decisions have been made to cut rates, such decisions are still being made at a gradual pace. Factors like housing costs will remain a significant issue, putting pressure on construction markets to build more. But such projects largely remain under development, keeping this problem afloat and continuing the cost of living issue. Unemployment will also be a sticking point as the population rate expands and job cuts and layoffs will accelerate.

Geopolitically, the world is still dealing with the Russia-Ukraine war. As NATO countries like Canada are supporting Ukraine through arms shipments and aid packages, the war itself has been put at a near-standstill, preventing what might be a more politically and financially harrowing outcome. Efforts to scale up energy production will support countries like Canada and their many industries, especially with sanctions on Russian energy now being enforced by the government. Developments like the Houthis attacking certain trade routes in the Red Sea will keep those routes from being taken, potentially leading to more volatility in the country's supply chains. Politically, Canada is getting close to its next election year, with various local elections now taking place. This will determine the balance of power and shape legislation.

Distributing risk ratings

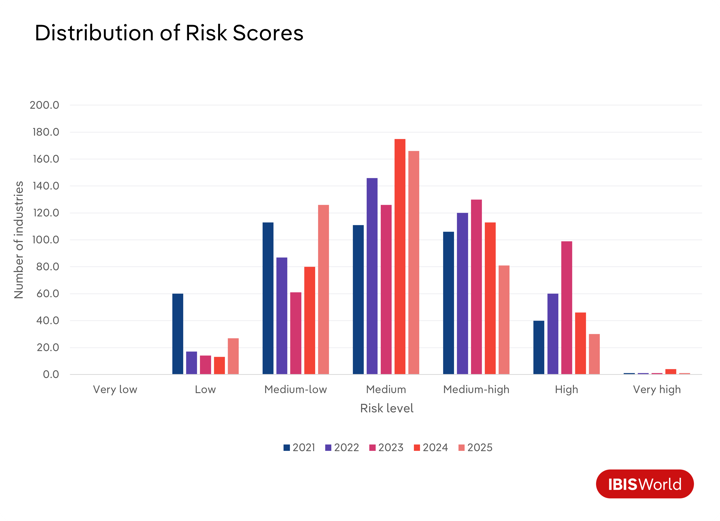

- As the effects of the pandemic eased in 2021, risk levels moderated, with 34.1% of industries rated as a medium-high or greater risk.

- With growth in consumer spending and inflation risk levels in 2022, 42.0% of industries rated as a medium-high or greater risk.

- Although the pandemic has officially been declared over, rising inflation drove up risk levels across the economy, resulting in 53.4% of industries rated medium-high or higher.

- As inflation reaches target rates, risk levels are expected to ease through the end of 2024 and into the outlook period. This results in 37.8% of industries being rated as a medium-high or greater risk in 2024 and just 26.0% in 2025.

Sector highlights

Construction

The construction market is expanding again, with various projects gaining more steam. Public initiatives like the Investing in Canada Infrastructure Program are helping infrastructure projects obtain the necessary funding to support this industry. Residential markets have also been getting more attention lately, especially during the Canadian housing crisis, elevating investments in these various projects. Such factors benefit sectors like Industrial Building Construction and Apartment & Condominium Construction in Canada.

Real estate and rental and leasing

Housing remains a top concern in the country now, with a higher cost of living making it so. The need for housing is boosting sectors like real estate and rental during this period. A growing population is also fueling housing needs, promoting the need for real estate services and rental units despite higher rental costs and mortgage rates in the period. These factors are helping sectors like Apartment Rental and Real Estate Sales and Brokerage in Canada.

Mining

A need for certain minerals and energy remains a top brass matter in the country, creating value for any service that can generate these items. The government has been supporting the mining sector more with its Critical Minerals Strategy, listing various minerals that will get support from the government and helping industries get a boost in the period. Energy items have rebounded lately, with inflation and the Russia-Ukraine war influencing more gasoline production in light of Canada's decision not to allow various Russian products to be sold in their country. Such decisions are helping fuel the Oil Drilling and Gas Extraction and the Mineral and Phosphate Mining industries.