Data drives everything I do. After years leading sales and marketing strategies at financial institutions, I've seen firsthand how numbers—not instinct—should guide business development decisions.

This conviction led me to launch SIBCO Strategies, where we help organizations embrace data-driven decision-making. In the banking world, in particular, it’s no longer just about competing with the institution down the street. Fintechs and alternative lenders are disrupting traditional banking with promises of faster, easier solutions.

But the challenge goes beyond speed. Every client interaction is measured against the best service they've experienced anywhere—be it in retail, tech, or entertainment. For banks to win and retain business, they must match or exceed these cross-industry service standards. The competitive edge lies in combining the stability of traditional banking with the customer experience modern clients expect.

In this fast-evolving banking landscape, knowing where to focus business development and how to differentiate your services can be challenging. But with data on your side, finding that path to growth is possible.

Watch and learn as I walk through how I use industry data to drive geographic expansion, specialization and portfolio health.

Here are my top three strategies for data-driven business development:

1. Use data to identify regional growth opportunities

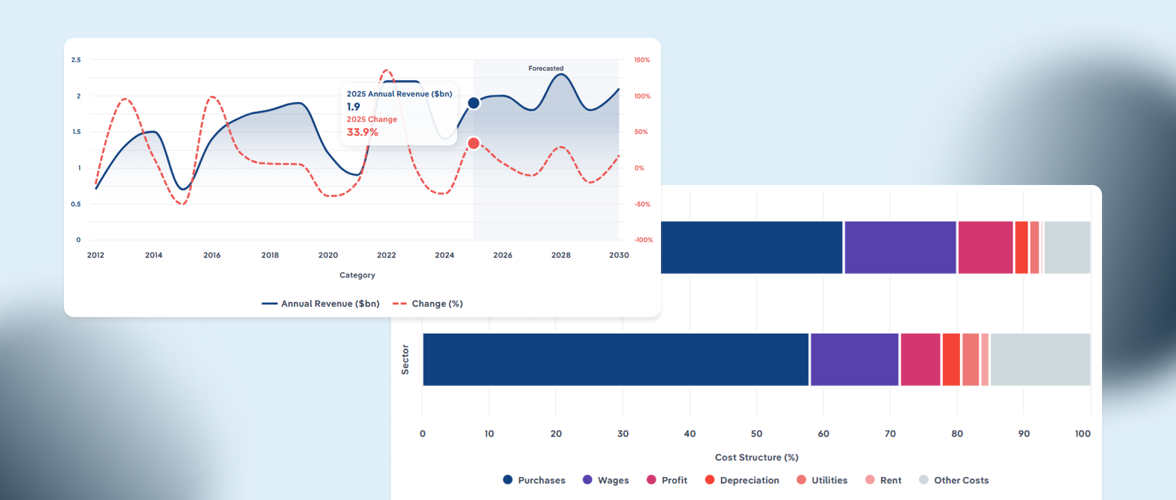

Identifying thriving industries in your local area can create valuable opportunities. By analyzing regions with booming economic activity, you can align your business offerings to meet existing market needs.

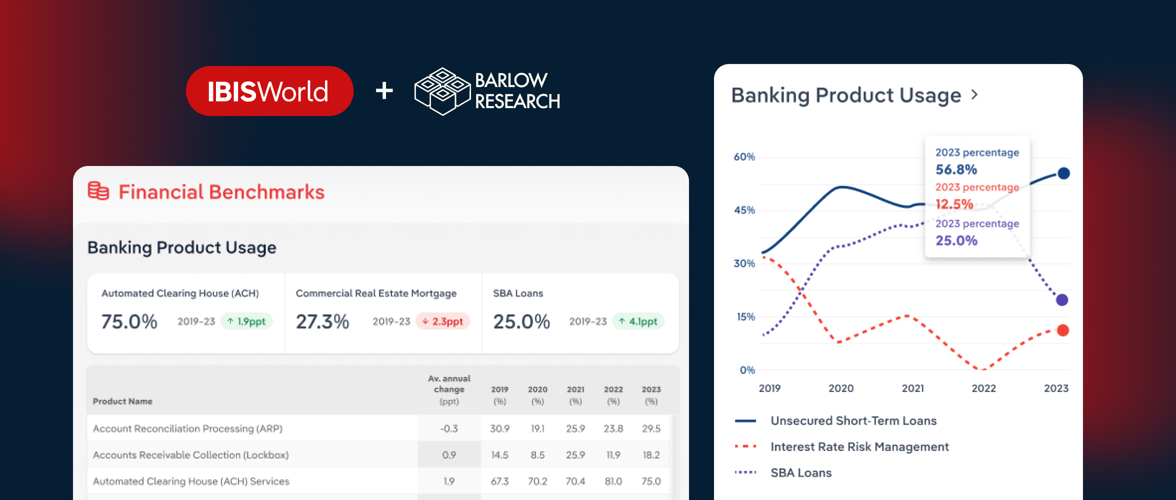

For example, suppose you’re a banker looking to expand into high-growth industries. Using IBISWorld's data, you could identify regions experiencing manufacturing growth. These businesses often require loans, cash flow management solutions, and other financial services. By tailoring your pitches to address these needs and aligning with their goals, you create relevant, timely solutions that resonate.

Here’s how the approach works in practice:

- Identify regions with strong economic growth in the industries you serve.

- Analyze the specific financial needs of businesses in those industries.

- Develop targeted outreach strategies to address their challenges and opportunities.

This alignment not only enhances your client engagement but also significantly increases your chance of securing new business.

2. Serve specialized industries

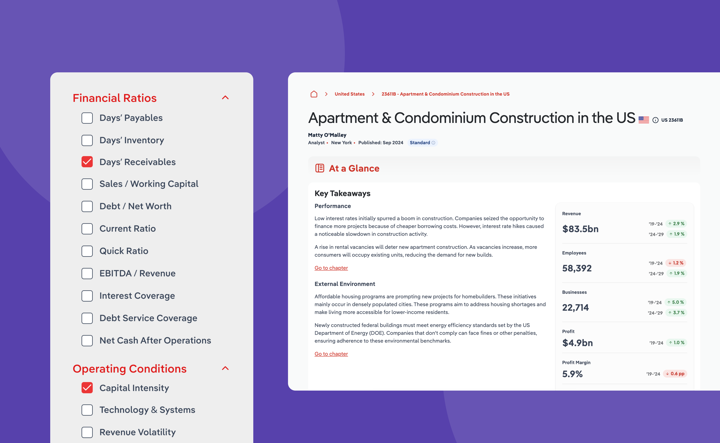

Another effective growth strategy is focusing on industries best positioned to benefit from your products or services. High-growth industries with unique regulatory or financial needs often present the most opportunity.

Take the construction industry, for instance. With its rapid growth, high capital intensity, and significant cash flow demands, construction companies often need tailored financing solutions.

By leveraging IBISWorld’s data, you can identify industries like these and craft pitches that directly address their specific challenges. Highlighting the ways your products can solve their financial pain points demonstrates deep understanding, builds credibility, and makes your proposals highly compelling.

3. Monitor risk management and portfolio health

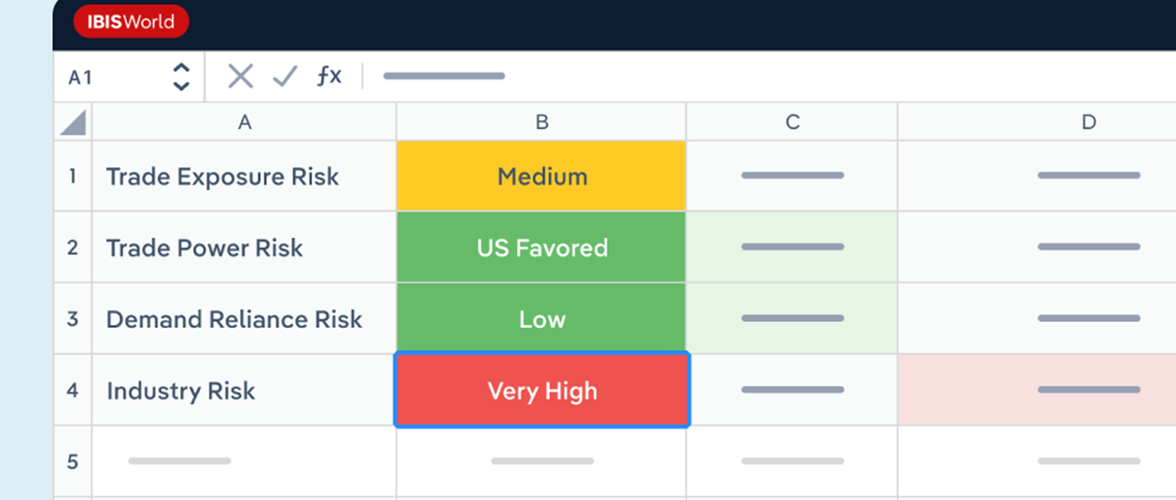

Maintaining a solid book of business requires careful risk management. Leveraging IBISWorld's cash flow and risk indicator data can help you monitor an industry’s financial health while identifying red flags.

For example, if market disruptions alert you to potential financial instability in a sector like retail or manufacturing, this data can guide you in offering treasury management or cash flow solutions tailored to those industries. This approach not only protects your own business but also strengthens client relationships by showing your commitment to their long-term success.

By continuously monitoring risk and staying attuned to market changes, you’ll strengthen the stability of your portfolio and foster trust with your customers.

Final Word

Data-driven business development strategies are transforming how we approach growth. From focusing on regional opportunities and selecting high-impact industries to risk management, leveraging IBISWorld’s industry reports and tools is vital to success.

If you’d like to discuss how SIBCO can help with your business development strategy, don’t hesitate to reach out at will@sibcocreative.com. Together with IBISWorld’s powerful data, we can chart a path for confident growth in today’s fast-moving market.