Key Takeaways

- Apple Inc. rolled a new iOS update in April 2021 that changed applications’ access to user data.

- Companies that rely on third-party data for advertising have been the most affected by this new iOS update.

- Establishment growth among e-commerce companies could slow following the iOS update.

A small change

In April 2021, Apple Inc. (Apple) rolled out a new version of its operating system, iOS, with an updated privacy policy that changed permissions for apps to track user data from opt-out to opt-in.

This means that users had to actively tap “Allow” or alternatively, “Ask App not to Track” for apps to access the users’ Identifier for Advertising (IDFA), which iOS apps use to track user data across platforms and provide targeted ads.

Behavioral economics tells us that a subtle nudge, such as an opt-in system, can have an outsized effect on how a population behaves. Indeed, most users have opted out of being tracked since the change was made.

A big effect

This is a massive blow for many internet-based businesses and industries that relies on third-party data for advertising. Most notably, this includes Meta Inc., which operators Facebook, as well as Snap Inc., which have both experienced a hit to revenue growth as the ads they serve on their platforms become less effective once consumers opt out.

In turn, the policy has affected the businesses that previously relied on these ads to reach consumers.

And while, at first glance, this seems like a huge victory for consumer privacy, and because Apple has certainly been eager to advertise itself as a privacy-first company, advertisers’ dollars will likely flow to user data like water to low ground moving forward.

However, there is a possibility that apps can track users through “fingerprinting”, where they collect enough miscellaneous data to create a unique identifier. Apple has policies forbidding the practice, but effective policy requires effective enforcement.

The main effect here is a shift in power to companies that deal in first-party data, such as large platforms like Google, Amazon, and notably, Apple.

These players command a large enough share of their respective markets and users’ time and attention that they produce enough data to effectively advertise without needing to know about what goes on elsewhere on the internet.

Indeed, shifting some ad spending from Facebook to Google seems to be one typical response to Apple’s update. Apple has, as a result, also increased revenue for its own ad services.

What may happen next

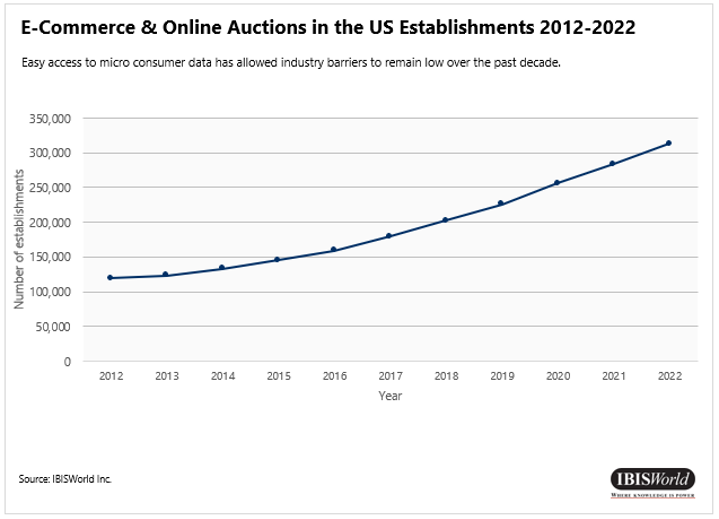

The E-Commerce and Online Auctions industry has experienced a growing number of establishments in recent years, rising at an annualized rate of 11.7% over the five years to 2022. The easy availability of third-party data has contributed to the low barriers to entry that have enabled this establishment growth.

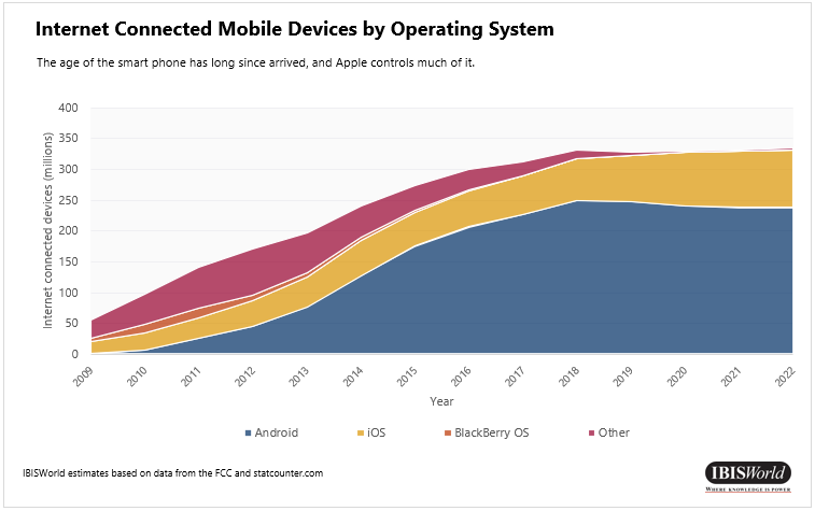

Moving forward, establishment growth could slow following Apple’s iOS change; further, it could also slow if Google makes a similar privacy change to its Android operating system in response to Apple’s advertising.

And while a company could switch from advertising its products through Facebook ads to selling and advertising on Amazon, they would only be successful until Amazon begins producing the same product itself, effectively cutting out the middleman altogether.

In general, companies large enough to have large amounts of first-party data will have more power and more will to use it when smaller operators are forced to play by their rules on their platforms.

Ultimately, businesses have little to no incentive to protect consumer data, only to keep it for themselves.