Key Takeaways

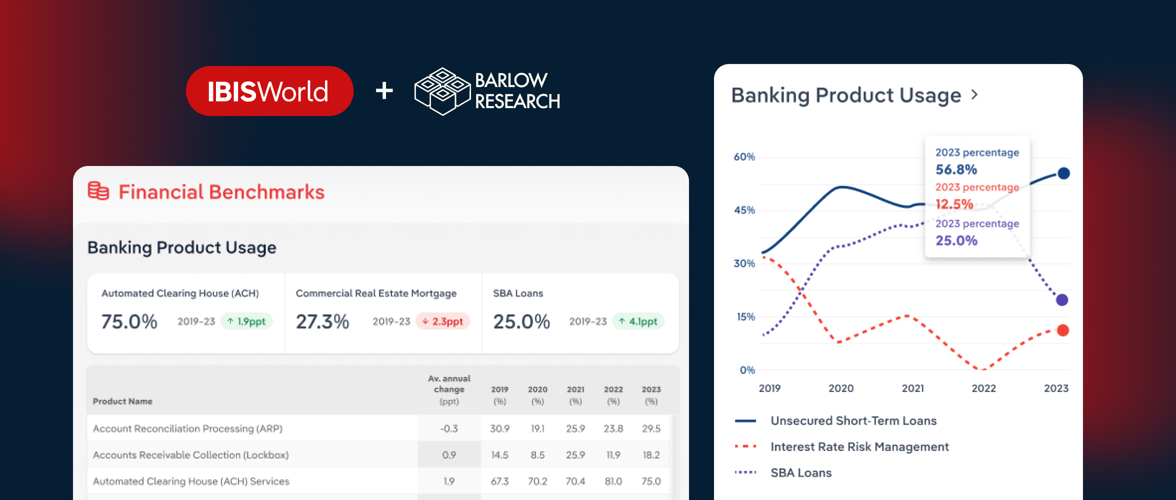

- Industry-specific financial behaviors help banks align deposit and loan offerings with customer needs.

- Industry research uncovers new opportunities in emerging or underserved markets, enabling strategic expansion.

- Leveraging industry insights allows financial institutions to provide more targeted and effective products.

As financial institutions work to grow deposits and expand commercial lending, understanding the right customer industries and markets is essential. Different businesses have unique financial needs—those with excess inventory require different banking solutions than those with surplus cash. To succeed, bankers must go beyond offering standard products and instead act as strategic advisors, matching solutions to each client’s specific situation.

In the latest episode of American Bankers Association’s podcast, IBISWorld’s Jim Fuhrman, Senior Director of Client Services, explores how industry research helps financial institutions develop targeted go-to-market strategies, including:

- Key industry indicators banks should track when identifying ideal customer segments

- Ways to align commercial lending and deposit products with market trends

- How research can reveal new opportunities for growth

By leveraging data-driven insights, banks can strengthen their market position, optimize their offerings, and build deeper client relationships.

Listen now to discover how industry research can sharpen your strategy and drive smarter banking decisions.