Key Takeaways

- Meaningful, insight-driven client conversations help close knowledge gaps, reveal opportunities and foster deeper customer relationships.

- Solution-focused sales, tailored to client needs and backed by expanded product offerings, are essential for winning customer loyalty and driving business growth.

- Strategic partnerships and industry advocacy amplify trust, innovation and success – positioning banks as key players in the market.

2024 was a big year for the banking industry, full of lessons learned and opportunities identified. As we look back, several trends stood out that can help shape business strategies moving forward. From client relationships to technology, here’s a recap of what defined 2024 and how we can use these insights for a successful 2025.

Building better relationships with clients

Understanding your customer’s business is the foundation of effective banking. As Barlow Research identified a 15% gap between customers’ expectations and bankers’ perceived knowledge of their business, our team has worked with industry leaders to identify best sales practices to bridge this gap. A great example of this came in a conversation between IBISWorld and Capital Performance Group.

Demonstrating the value that playbooks bring to a conversation, IBISWorld analyzed our own customer engagements in 2024, and the results are certainly worth consideration.

Last year, the IBISWorld Banking Team held 1,392 meetings, totaling more than 40,000 minutes of client conversations. These interactions weren’t just about checking boxes; they focused on sharing relevant, timely, and actionable information.

The benefits of structured playbook, led by agendas and insights, were clear. In meetings where insights were shared, our customer’s talk ratio improved from 35% to 50%, adding an extra 5 minutes of valuable dialogue. These 5 extra minutes are where the magic happens—where true pain points and opportunities are identified, allowing us to be the advisors our customers expect.

Key takeaway: Bridge the knowledge gap by focusing on meaningful, insight-driven client conversations to uncover opportunities and strengthen relationships.

Winning the wallet: Expanding product offerings

Aided by the topic above, “Building Better Relationships with Clients,” “Winning the Wallet” will be the pipeline building concept that drives growth in 2025. It isn’t just about closing transactions; it’s about building relationships and identifying customer needs. Over the past two years, many lenders faced the challenge of scaling their offerings from simple deposits to more complex solutions like treasury management and lending products such as traditional commercial and industrial (C&I) and asset-based lending (ABL). Expanding into these new areas requires asking the right questions, actively listening, and offering tailored solutions. The success of 2024 emphasized that solution-focused sales—rather than transaction-focused—is the way forward.

Key takeaway: Focus on solution-driven sales by listening to client needs and expanding offerings with tailored, value-added solutions.

Lending: A top priority for 2025

Included in the quest to “Win the Wallet,” lending pipeline is in the crosshairs. For most bankers, lending remained the top priority in 2024. However, many felt they underperformed in meeting lending expectations, either due to concerns over higher borrowing rates, or shifting business priorities. Building a strong lending pipeline is already shaping up to be a key focus for 2025. This will require not only sharpening sales skills but also aligning teams with tools and strategies that support proactive customer engagement.

Key takeaway: Prioritize building a lending pipeline by enhancing sales strategies and leveraging tools for proactive engagement.

The role of industry advocates

It’s one thing to hear about a solution from the vendor selling it, but it’s entirely different to hear about it from peers who are using the solution. This year, we collaborated on presentations with leaders from our customers at Citi, Regions, South State Bank, F.N.B., Space Coast Credit Union, Morton Community Bank and Farmers State Bank of Alto Pass. These sessions covered a range of topics like sales strategy, risk management, marketing and customer advisory. By demonstrating our solutions’ value across the entire loan cycle, we reinforced our commitment to being a trusted partner in the banking ecosystem.

Key takeaway: Partner with industry advocates to showcase the real-world success of your offerings and build trust within the banking community.

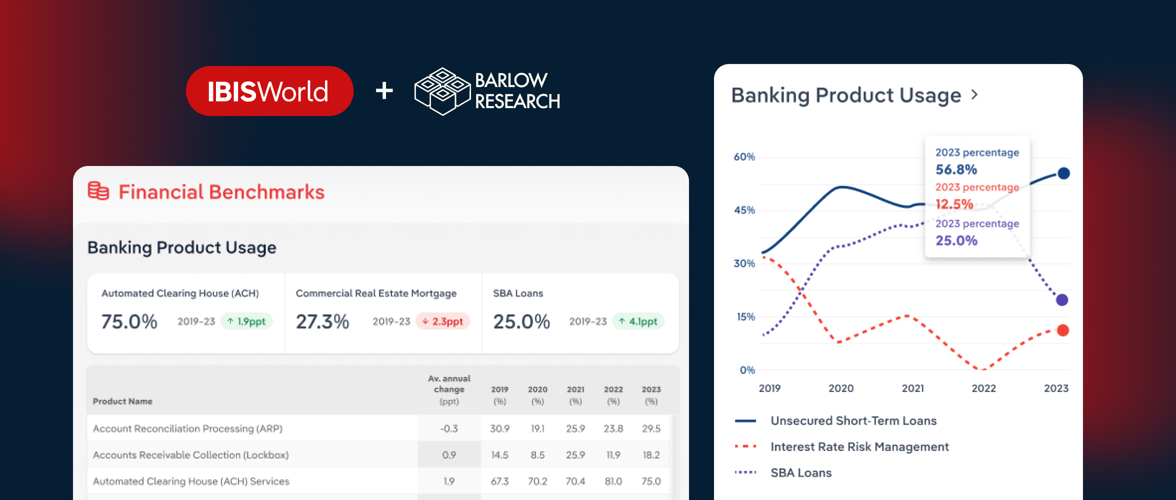

The role of strategic partnerships

In a rapidly evolving industry, collaboration is key. At IBISWorld, we’ve been fortunate to work with exceptional partners like RelPro, Barlow Research, Anthony Cole Training, Capital Performance Group, Devon Risk Advisory Group and MKInsights2Action. These partnerships have helped us build a stronger network to support bankers and their clients. In addition to these collaborations, we hosted an event with RelPro and Barlow Research and attended eight conferences with industry leaders. These opportunities allowed us to exchange ideas, learn from others and stay ahead of trends.

Key takeaway: Cultivate strategic partnerships to strengthen your ecosystem, drive innovation and remain ahead of industry trends.

Centralizing tools for better efficiency

Across industries, businesses are simplifying workflows by integrating resources into single platforms to eliminate the overload of browser tabs. In banking, this trend includes combining sales tools, risk management systems and credit approval processes into core customer relationship management (CRM) systems. Through this approach, teams can streamline operations and focus more on serving clients effectively.

Key takeaway: Integrate tools into centralized platforms to improve efficiency, reduce complexity and enhance client service delivery.

SWOT of AI

Having discussed the AI trend with banking regulators, the benefits of time saving and standardization are clear, but the path to reach them is murky, and new options appear on the market seemingly every day. Artificial intelligence (AI) is here to stay, so it’s important to understand just how it can enhance different areas of life and business. In lower-leverage situations, like generating a dinner recipe, quality control is less of a concern. But in highly regulated industries, like banking, it’s crucial to understand the trustworthiness of your sources so that you can place your own seal of approval on the findings. The temptation to choose the quickest – and sometimes free – answer is real.

Key takeaway: AI presents the opportunity for tremendous time savings but also presents the risk of poor source data, and therefore must always be human verified.

Balancing automation with the human touch

Speaking of AI, automation has become a critical tool for scaling customer interactions. At IBISWorld, we use Outreach to connect with enterprise customers efficiently. While tools like this help deliver relevant information at scale, they come with challenges. As inboxes fill up quicker than ever, standing out requires more than just automation. Picking up the phone, scheduling agenda-driven meetings and adding a personal touch to the sales process are essential to maintaining a competitive edge.

Key takeaway: Supplement automated communication with personal interactions to enhance client engagement and keep your competitive edge.

Final Word

As we prepare for 2025, the lessons from 2024 will guide our priorities. From addressing gaps in customer understanding to building stronger lending pipelines, the focus will remain on relationships, collaboration and innovation. By continuing to share insights, leverage technology and listen actively, the banking industry can meet the challenges ahead and thrive in the years to come.

2024 was a year of growth and reflection. The insights gained will undoubtedly shape a brighter future for banks and their clients. Here’s to building stronger partnerships, smarter solutions and a more connected industry in 2025.